Unveiling the Robust U.S. Economic Landscape Ahead of the Federal Reserve Meeting

The Bureau of Labor Statistics released three statistical reports on September 14:

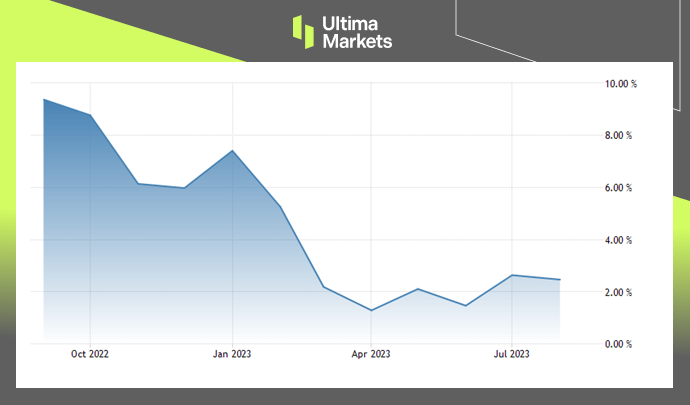

1. Retail sales

U.S. retail sales in August increased by 0.1% on a monthly basis higher than market expectations, and the annual growth rate increased from 2.6% to 2.5%. Retail sales in August were mainly driven by the sharp increase in gas station sales mom from 0.1% to 5.2%, reflecting the rebound in oil prices.

Other categories also generally showed positive growth, with more significant increases including automobiles and parts from -0.4% to 0.3%, electronics Supplies -1.1%→0.7%, and dining out and catering 0.8%→0.3% showed a slowdown.

Overall, retail sales in August were partly due to the recovery in gasoline prices, but retail sales excluding automobiles and gasoline were also higher than market expectations. (0.2% vs. 0.1%), the control group dropped from 0.7% to 0.1%, which was still better than the market expectation of -0.1%, highlighting that the US consumer market is still strong.

(Retail Sales data, BLS)

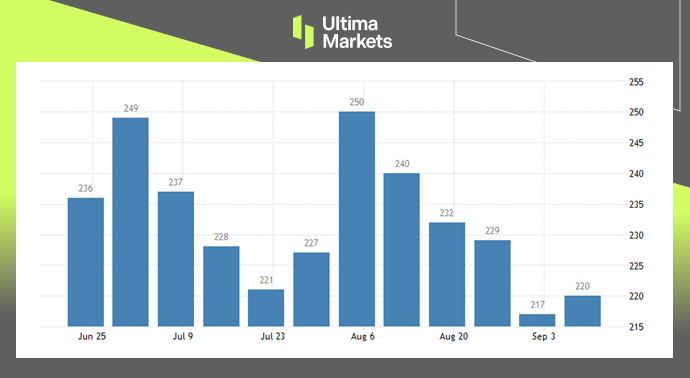

2. Initial jobless claims

Last week, the number of initial claims for unemployment benefits increased by 3,000 from 217,000 to 220,000, lower than the expected 225,000.

The number of continuing claims for unemployment benefits in the previous week increased by 4,000 from 1.684 million to 1.688 million, which was lower than the market estimate of 1.69 million people, showing that the job market is cooling more slowly than expected.

(Initial Jobless Claims, BLS)

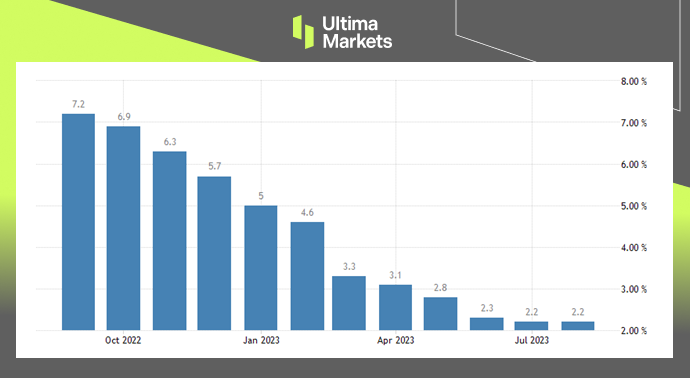

3. PPI (Producer Price Index)

The August producer price index (PPI) increased by 1.6% year-on-year, higher than market expectations of 1.2% and the previous value of 0.8%, growing for the second consecutive month.

Excluding volatile food and energy prices, the August core PPI rose by 2.2% YoY, in line with market expectations and lower than the previous value of 2.4%.

The growth of PPI in August was mainly driven by rising energy and transportation costs.

(Core PPI, BLS)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4