The euro has ascended towards $1.09, marking its peak since January 24th, spurred on by a declining dollar due to less-than-anticipated employment growth in US’s private sector and the Federal Reserve Chair Jerome Powell’s mild hawkish tone regarding reductions in interest rates. Investors have additionally shifted their attention toward Thursday’s monetary policy meeting of the European Central Bank, desiring to gain deeper knowledge into the financial institution’s policy future.

Notwithstanding that policymakers are predicted to retain interest rates at their unprecedented highs, market participants will scrutinize revised economic forecasts and clues from President Christine Lagarde on the timeline for probable descents in the cost of borrowing. The latest reports indicate a deceleration in the Eurozone’s inflation for the second successive month to 2.6% in February, down from 2.8 % in January 2024.

(EUR/USD Yearly Chart)

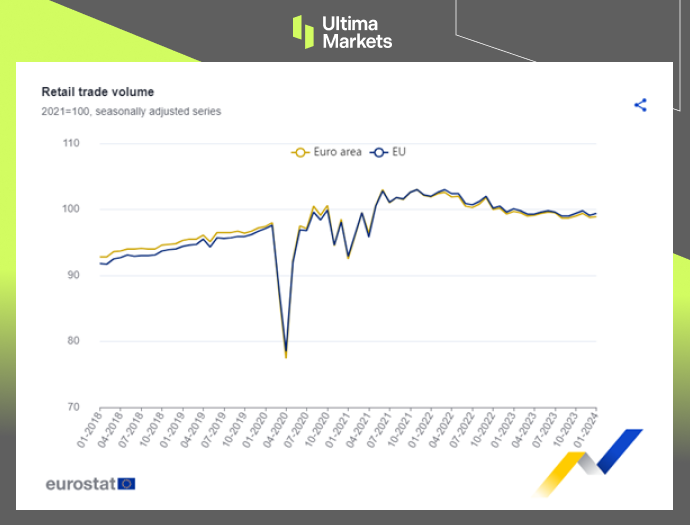

Additionally, in January 2024, the Euro Area saw a slight 0.1% increase in retail sales month-over-month, following a revised 0.6% shrinkage in December, which matches market forecasts. Products including food, beverages, and tobacco saw sales go up by 1.0%, halting a three-month downturn, and automotive fuel registered a 1.7% advancement, marking the highest since August 2022. Conversely, non-food products experienced a 0.2% dip, preceded by a 0.9% decrease in the previous month. On an annual level, retail sales recorded a downfall of 1.0%, signifying the 16th month of continuous reduction.

(Retail Sales,EUROSTAT)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4