The FTSE 100 saw a growth of 0.3%, climaxing at a new ten-month record of 7,772 on Wednesday, which makes it the third winning session. Encouraging economic indicators stimulated the market, generating hope that the UK is bouncing back from its economic downturn.

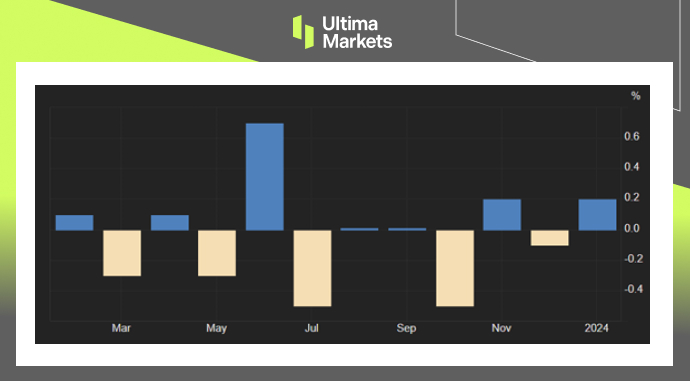

In January 2024, the UK economy showed a moderate increase of 0.2% monthly, counteracting a 0.1% decline in the prior month, and in line with market expectations. This marks a recovery from the technical recession which took place during the second half of 2023. The significant boost primarily originated from the services sector (notching up 0.2% compared to a drop of 0.1% in December), particularly from retail trade excluding vehicles and motorcycles (surging 3.4%), the health sector alongside growth in the market sector (up 0.9%), and education (rising 0.7%).

Concurrently, the construction sector posted a growth of 1.1% (as compared to a decline of 0.5% previously). Conversely, there was a slump of 0.2% (against a climb of 0.6% previously) in industrial production, primarily precipitated by a 2.2% decrease in water supply and sewerage, waste management, and remediation activities. Over a three-month period leading up to January, the UK economy recorded a slight contraction of 0.1%.

In January 2024, the United Kingdom saw a 0.7% increase in exports of goods and services, reaching £69.26 billion, bouncing back from a one-and-a-half-year low of £68.76 billion in December. Goods exported to the European Union rose by 0.8%, largely fueled by heightened sales of fuels, particularly crude oil to Poland and refined oil to Belgium and chemicals. However, a fall in exports of machinery and transport equipment was noticed, linked to a dip in car exports to Spain and aircraft exports to Germany.

On the other hand, non-EU countries recorded a 1.7% drop in exports, primarily due to reduced sales of fuels, including a decline in crude oil exports to South Korea, and a notable dip in exports of medicinal, pharmaceutical products, and inorganic chemicals to the US. To conclude, a marginal 0.3% rise was seen in the export of services.

(FTSE 100 Index Monthly Chart)

(UK GDP MoM, Office for National Statistics)

(UK Exports, Office for National Statistics)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4