U.S. Treasury Demand Drops as Investors Seek Non-U.S. Safe Havens

TOPICSTags: Bond Price, Bond Yield, Gold, gold analysis, Safe-Haven, Trade War, US Bond, US Treasury Yield, XAUUSD

The U.S. bond market experienced significant volatility last week amid escalating U.S.-China trade tensions. On Friday, China announced additional retaliatory tariffs on U.S. imports—raising rates from 84% to 125%—which took effect on April 12.

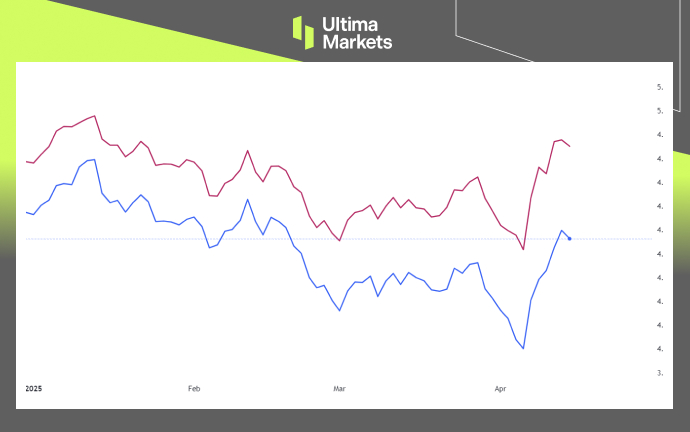

U.S. Treasury Yields Climb on Weak Demand

Treasury yields surged to a two-month high, with the 10-year yield rising to 4.48% and the 30-year climbing to 4.85%, signaling a notable sell-off in long-duration U.S. government bonds.

Reports indicate that countries such as China are reducing their U.S. Treasury holdings, contributing to higher yields and a weaker U.S. Dollar. The combination of aggressive tariff policies and growing political uncertainty has triggered broad selling of U.S. assets.

In the latest 30-year bond auction (April 2025), primary dealers had to absorb 18.2% of the $24 billion issuance—the highest share since December 2021—indicating reduced demand from other buyers.

Similarly, the 3-year note auction on April 8 saw indirect bidders (typically foreign central banks) accounting for just 79.3% of purchases—the lowest since December 2023.

(US 10- and 30-Years Treasury Bond Yield; Source: Trading View)

This soft demand led to a surge in Treasury yields, highlighting growing investor caution.

Market Implications

The decline in demand for U.S. Treasuries could continue to push yields higher, raising borrowing costs for the U.S. government. This presents a growing challenge for the Trump administration, which has been attempting to lower interest rates.

Persistently weak demand may also reflect waning confidence in U.S. fiscal management and economic stability—factors that could weigh further on U.S. financial markets.

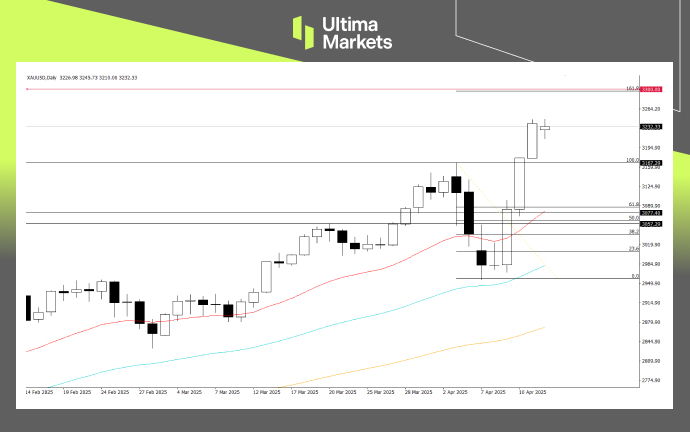

Gold Surges as Primary Safe-Haven Asset

Gold extended its rally last week, soaring over $200 in just three days to reach another all-time high, highlighting strong safe-haven demand amid elevated global uncertainty.

The current risk-off environment is driving capital away from traditional assets and into gold, even as U.S. Treasuries—typically viewed as a safe-haven—come under pressure from weakening demand.

(XAUUSD, Day-Chart; Source: Ultima Market MT5)

From a technical perspective, gold maintains a broad bullish outlook, with the breakout above $3,167 now acting as key support.

Using the Fibonacci extension, the next potential upside target lies near $3,300, aligning with the 161.8% extension level.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server