US PCE Index Holds Steady in May 2024, Showing Signs of Easing Inflation

TOPICSTags: Dollar Index, Inflation, PCE

The Personal Consumption Expenditure (PCE) price index in the United States remained unchanged in May 2024 compared to the previous month, marking the smallest change in six months. It follows a 0.3% increase in April and aligns with economists’ forecasts. Breaking down the index, prices for goods decreased by 0.4%, while prices for services saw a modest increase of 0.2%.

The core PCE index, which excludes volatile food and energy prices, rose by 0.1% in May. This represents the smallest increase since November 2023 and is lower than the 0.3% rise observed in April. The result also matched forecasts.

Looking at specific categories, food prices inched up by 0.1%, while energy prices experienced a significant decline of 2.1%. These figures contribute to the overall picture of easing inflationary pressures in the economy.

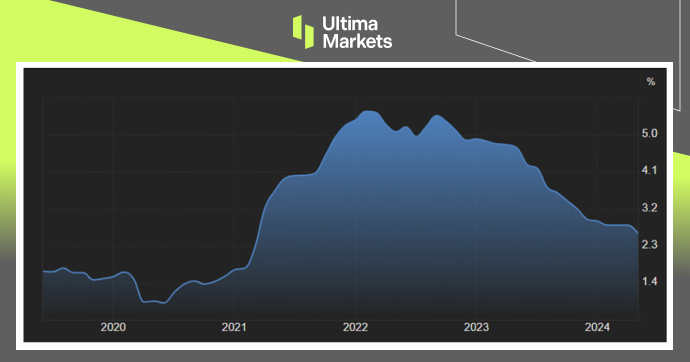

On an annual basis, both the overall PCE rate and the core PCE inflation rate decreased to 2.6%. For the core PCE inflation, this marks the lowest level since March 2021. These annual figures provide a broader perspective on the inflation trend, suggesting a gradual moderation in price increases over the past year.

These PCE figures are closely watched by economists and policymakers, particularly the Federal Reserve, as they provide crucial insights into inflation trends and consumer spending patterns. The data may influence future monetary policy decisions, including those related to interest rates.

The dollar gained approximately 1.2% in June and 1.3% in the second quarter. The currency’s strength is attributed to the Federal Reserve’s slower pace in relaxing monetary policy compared to other major central banks.

(Core PCE Price Index YoY%, U.S. Bureau of Economic Analysis)

(Dollar Index Monthly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server