Comprehensive USDX Analysis for September 26, 2023

In this comprehensive analysis, Ultima Markets brings you an insightful breakdown of the USDX for 26th September 2023

Key Takeaways

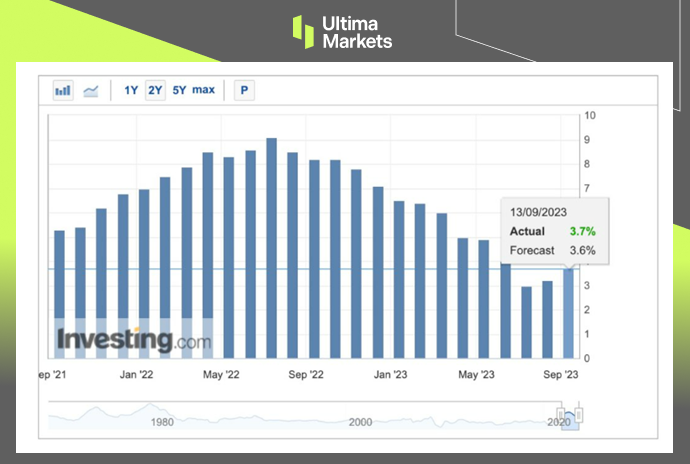

The Federal Reserve’s stance has emerged as the linchpin shaping the USDX’s performance.

While September saw a halt in interest rate hikes, the dot plot projections signal a potential resurgence in rate increases later in the year.

This is underpinned by a forthcoming, more hawkish monetary policy in the next year, with a notable reduction in the number of projected interest rate cuts.

USDX Technical Analysis

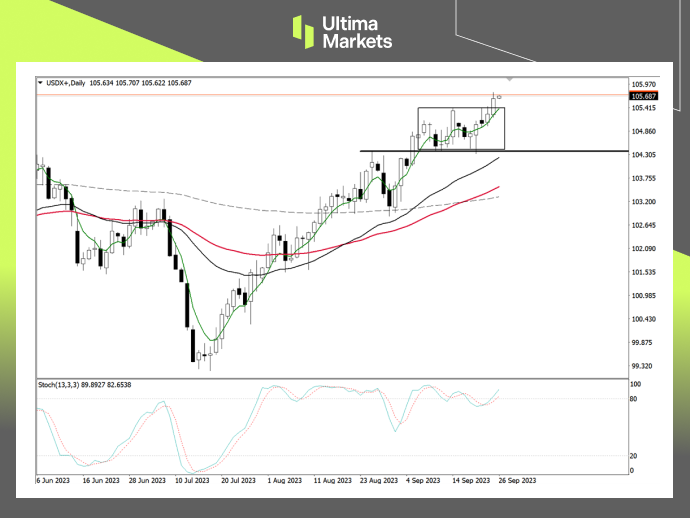

USDX Daily Chart Insights

( Daily chart of USDX, source: Ultima Markets MT4)

Turning our focus to the technical landscape, the USDX exhibits compelling upward momentum.

The daily chart reveals a breakthrough as the US Dollar Index’s price closes above its consolidation range’s upper boundary.

Moreover, the stochastic oscillator, a pivotal technical indicator, has signaled a bullish trajectory.

USDX 1-Hour Chart Analysis

(1-hour chart of USDX, source: Ultima Markets MT4)

The one-hour chart presents a more granular picture, with the ATR combination indicator affirming the effectiveness of the recent breakthrough.

Although retracement is conceivable during the Asian trading session, a market rebound is anticipated. The initial target is fixed at the support price of 105.443.

Ultima Markets Pivot Indicator

(1-hour chart of USDX, source: Ultima Markets MT4)

Ultima Market’s MT4 pivot indicator designates the day’s central price at 105.527. For investors and traders, here are the essential projections:

Bullish Scenario:

- Bullish above 105.527

- First target: 105.874

- Second target: 106.123

Bearish Scenario:

- Bearish below 105.527

- First target: 105.282

- Second target: 104.937

These projections, though subject to market dynamics and emerging data, provide a compass for navigating the ever-evolving terrain of financial markets.

Conclusion

To navigate the complex world of trading successfully, it’s imperative to stay informed and make data-driven decisions. Ultima Markets remains dedicated to providing you with valuable insights to empower your financial journey.

For personalized guidance tailored to your specific financial situation, please do not hesitate to contact Ultima Markets.

Join Ultima Markets today and access a comprehensive trading ecosystem equipped with the tools and knowledge needed to thrive in the financial markets.

Stay tuned for more updates and analyses from our team of experts at Ultima Markets.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2023 Ultima Markets Ltd. All rights reserved.

Pourquoi trader des métaux et des matières premières avec Ultima Markets ?

Ultima Markets offre l'environnement de coûts et d'échange le plus compétitif pour les matières premières les plus répandues dans le monde.

Commencer à traderSurveiller le marché en déplacement

Les marchés sont sensibles aux changements de l'offre et de la demande

Attrayant pour les investisseurs uniquement intéressés par la spéculation sur les prix

Liquidité profonde et diversifiée sans frais cachés

Pas de bureau de négociation et pas de requotes

Exécution rapide via le serveur Equinix NY4