Last week, the reports released by the three major oil organizations gave investors a better understanding of the short-term crude oil market. After oil prices have been rising for some time, major adjustments are expected this week.

Demand climbs as supply falls

In June 2023, global daily oil demand broke a record at 103 million barrels and is still expected to hit a peak in August. According to the IEA, demand for crude from the 13 OPEC members averaged 29.8 million barrels per day in the October-December period, much higher than the 27.9 million barrels expected in July. The OPEC monthly report shows that the growth rate of global crude oil demand in 2023 is expected to remain unchanged at 2.44 million barrels per day.

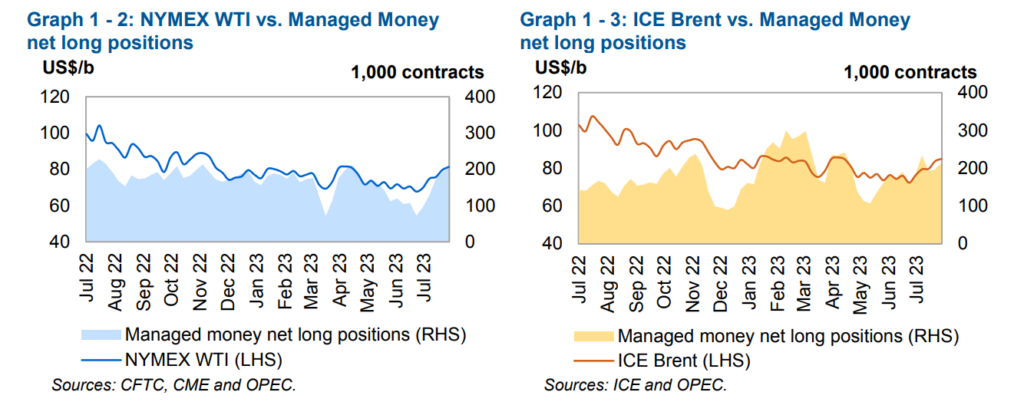

(Net long positions lifting oil prices, OPEC monthly report)

However, global oil supply fell by 910,000 barrels in July, mainly due to Saudi production cuts. Currently, crude oil inventories in developed countries are about 115 million barrels below the five-year average. That suggests an increasingly tight market, partly due to falling supply. In 2H2023, the IEA forecasts a reduction in global inventories of about 1.7 million barrels per day, suggesting further tensions in the market could result in a bigger impact to prices.

According to OPEC ‘s monthly report, unilateral production cuts by Saudi Arabia and reduced exports by Russia have brought the OPEC + members’ output to a near two-year low.

Unbalance between supply and demand leading price to swing

Oil prices maintained a steady uptrend in July. From an export standpoint, the export price of Russian crude has risen sharply, with an increase of US$ 8.84 per barrel, and the total price reached US$ 64.410. Still, Russia’s oil revenues are down by more than a fifth from a year earlier, according to the IEA. However, technically speaking, crude prices will face an adjustment in the short run.

(Daily chart of Brent crude, Ultima Markets MT4)

Based on the daily chart shown above, crude price has reached the important resistance area of 87-88 US dollars. The Stochastic Oscillator is also showing divergence as the price keeps trying to move above this resistance zone.

(1- hour chart of Brent crude, Ultima Markets MT4)

In the 1- hour period, the short-term moving average has completely declined, and the medium- and long-term moving average has completely fallen too, and the oil price has also made an effective correction. There is a certain downward pressure on oil prices within the day, and the bottom is looking at the upward trend line.

Overall, oil prices will see some downward pressure in the short run. However, with production cuts and stable demand growth, oil prices still have the momentum to rise this year.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Mengapa Trading Logam & Komoditas dengan Ultima Markets?

Ultima Markets menyediakan lingkungan trading dengan biaya paling kompetitif untuk komoditas umum di seluruh dunia.

Mulai SekarangPantau Pasar Di mana Saja

Pasar rentan terhadap perubahan penawaran dan permintaan

Menarik bagi investor yang menyukai spekulasi harga

Likuiditas yang dalam dan beragam, tanpa biaya tersembunyi

Tanpa dealing desk dan tanpa requote

Eksekusi cepat melalui server Equinix NY4