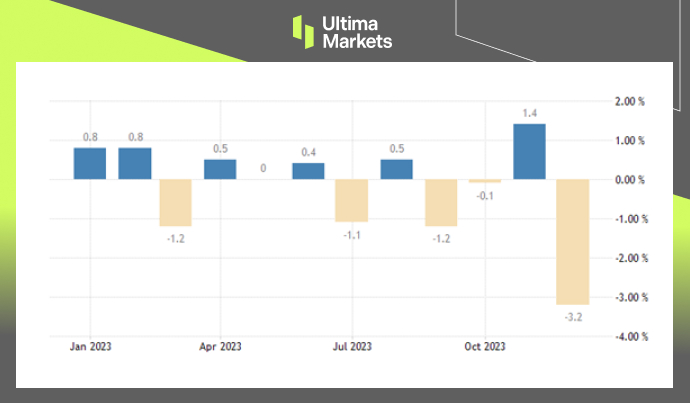

Bleak Retail Sales Figures Drive Sharpest FTSE Decline in Three Months

In the final month of 2023, the United Kingdom witnessed a significant downturn in retail sales, with a staggering 3.2% drop compared to November. This unexpected decline, far exceeding the anticipated 0.5% decrease, marked the most substantial monthly fall since the beginning of the pandemic in January 2021. The abrupt reversal followed a modest 1.4% increase in November, highlighting the persistent volatility in the retail sector.

Impact Across Retail Categories

Non-Food Stores Take a Hit

Non-food stores bore the brunt of the downturn, experiencing a sharp 3.9% decline. Consumers appeared to curtail gift purchases, possibly shifting more holiday shopping to November to navigate strained budgets.

Varied Sectoral Impact

The negative momentum affected various retail categories, including significant hits to department stores (-7.1%), household goods (-3.0%), clothing (-1.5%), and other non-food establishments (-4.5%). Even the food sector witnessed reduced trade activity, falling 3.1%.

Non-Store Retailing Slumps

Reflecting the pinch of inflation and higher living costs, non-store retailing slumped by 2.1%, emphasizing the broader economic challenges influencing consumer behavior.

Year-End Reflections: 2023 Retail Sales

Preliminary data for 2023 suggests an overall 2.8% decline in total retail sales for the entire year, reaching the lowest point since 2018. This extended downturn raises concerns about the future state of consumer confidence and purchasing ability.

(United Kingdom Retail Sales, Office for National Statistics)

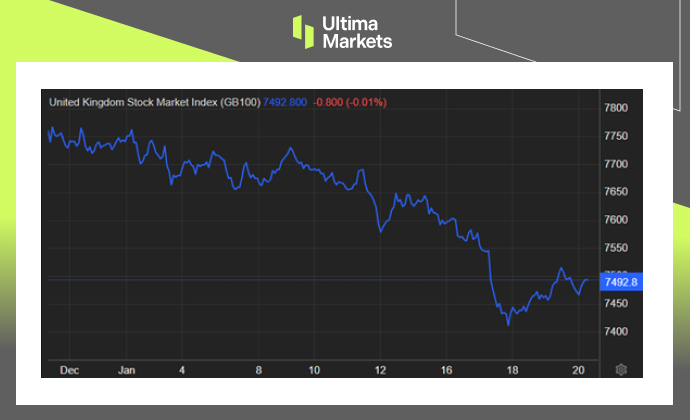

FTSE 100’s Response: Weekly Decline Amidst Retail Woes

Economic data released last Friday cast a shadow over the FTSE 100 index. Despite managing to close unchanged, the index experienced its third consecutive weekly decline, constituting the most substantial drop in three months.

(FTSE100 Monthly Chart)

Market Analysis and Investor Sentiment

Analysts are closely monitoring the impact of the retail sales slump on the broader market. The FTSE 100’s response reflects investor concerns about the resilience of the economy in the face of unexpected challenges.

Weekly Losses and Market Reactions

The FTSE 100’s flat closure belies the underlying unease in the market. Investors are navigating uncertainties stemming from the retail downturn, signaling a cautious approach in the face of economic challenges.

Expert Insights: What Lies Ahead

As the market grapples with the aftermath of the sharp retail sales decline, experts anticipate continued fluctuations. The intersection of inflation, interest rates, and global economic shifts adds complexity to the forecast, requiring investors to stay vigilant.

Frequently Asked Questions

Q: What caused the sharp decline in retail sales in December 2023?

A: The decline was fueled by a notable 3.2% drop in overall retail sales, surpassing expectations. Non-food stores, in particular, experienced a significant downturn of 3.9%.

Q: How did the FTSE 100 respond to the retail sales decline?

A: Despite managing to close unchanged, the FTSE 100 experienced its third consecutive weekly decline, indicating investor concerns and market unease.

Q: What is the outlook for the retail sector in 2024?

A: The prolonged downturn in 2023 raises concerns about the future state of consumer confidence and purchasing ability, necessitating a cautious approach from investors.

Expert Commentary and Industry Perspectives

Experts from LinkedIn and The Telegraph offer valuable insights into the market dynamics and the factors contributing to the current economic landscape.

For real-time updates and in-depth analysis, explore Yahoo Finance UK and Proactive Investors.

Conclusion: Navigating Uncertainties in the Economic Landscape

The sharp decline in retail sales at the close of 2023 has sent ripples through both the retail sector and the broader market. Investors are urged to stay informed and adapt to the evolving economic landscape influenced by factors such as inflation, interest rates, and global economic shifts.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server