Japanese Yen Weakens as BOJ Maintains Steady Interest Rates

TOPICSTags: BOJ, Kazuo Ueda, USDJPY, Yen

On Friday, the BOJ maintained its steady interest rates, with Governor Kazuo Ueda noting that the central bank could take time to monitor the effects of global economic uncertainty, indicating no urgency to further raise borrowing costs. This dovish stance led to a drop in the yen, casting doubt on whether the BOJ would hike rates again this year, a move previously anticipated by many in the market. As a result, USDJPY climbed 0.86%, closing at 143.85.

(USDJPY Daily Price Chart, Source: Trading View)

Governor Ueda mentioned that Japan’s economic conditions align with forecasts, supported by wage growth that is boosting consumption and helping inflation approach the BOJ’s 2% target. “The global economic outlook remains highly uncertain, with markets continuing to show instability. We must carefully assess these developments for now,” Ueda remarked during a news conference following the BOJ’s widely expected decision to hold short-term rates at 0.25%.

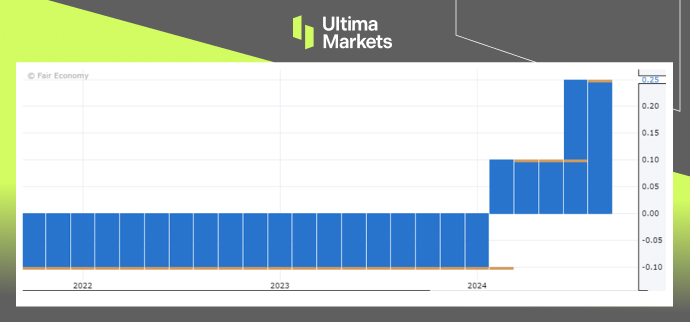

(BOJ Policy Rate, Source: Trading View)

The recent rebound in the yen has eased upward pressure on import prices, reducing the risk of domestic inflation overshooting. Meanwhile, Japan’s chief currency official, Atsushi Mimura, stated that authorities are closely monitoring the markets as a resurgence in yen carry trades could increase volatility. He added that most yen carry trades from the past have likely been unwound.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server