La Liga, Villarreal vs Barcelona

Transforming Goals into Gains with the Villarreal vs. Barcelona Clash!

Written on October 14, 2024 at 9:51 am

Bank Of England, GBPUSD, Unemployment Claim

Focus on GBPUSD today – 11th OCT 2024

Written on October 11, 2024 at 4:16 pm

Dollar Slips on Weaker Labor Market and Rising Inflation

Written on October 11, 2024 at 3:51 pm

China, China A50, Interest Rate, US inflation

Focus on China A50 today – 10th OCT 2024

Written on October 10, 2024 at 2:24 pm

Cut rate, New Zealand, NZDUSD, RBNZ

New Zealand Cuts Rates by 50 bps as Expected

Written on October 10, 2024 at 2:06 pm

Q4 Investor’s Magazine: Riding the Market Waves and Seizing Opportunities!

Written on October 9, 2024 at 2:38 pm

Cut rate, FED, Gold, Inflation

Gold Price Dips Sharply Due to Dynamic Factors

Written on October 9, 2024 at 11:48 am

Cut rate, Inflation, NZDUSD, RBNZ

Focus on NZDUSD today – 9th OCT 2024

Written on October 9, 2024 at 11:27 am

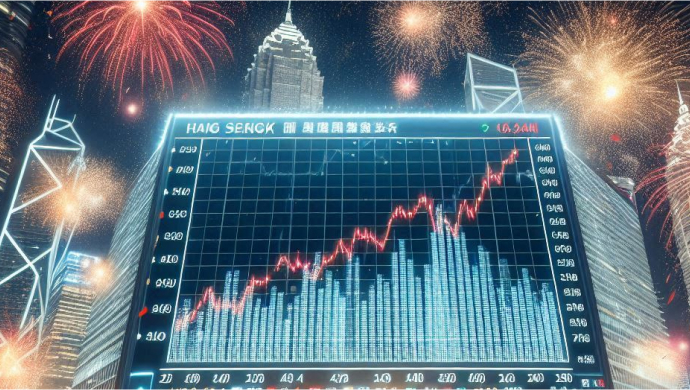

China, Hang Seng Index, HKSE, Hong Kong, Stock

Hang Seng Index Surges to 32-Month High

Written on October 8, 2024 at 12:01 pm