Hungary’s Recent Benchmark Interest Rate Cut and Economic Dynamics

In a decisive move on November 21, the National Bank of Hungary (NBH) implemented a 75 basis points reduction in the benchmark interest rate, bringing it to 11.5%.

This strategic decision, made amidst pressure for further rate cuts from the government, reflects the delicate balance between stimulating economic growth and maintaining cautious monetary policies.

Hungary’s Inflation Dynamics

Hungary currently grapples with the highest inflation rate in the European Union. Initially peaking at a staggering 25% in the first quarter, inflation has gradually eased to 9.9% last month, defying earlier forecasts.

Despite this decrease, the NBH remains vigilant, emphasizing a gradual approach to rate adjustments.

NBH’s Response to Inflation Trends

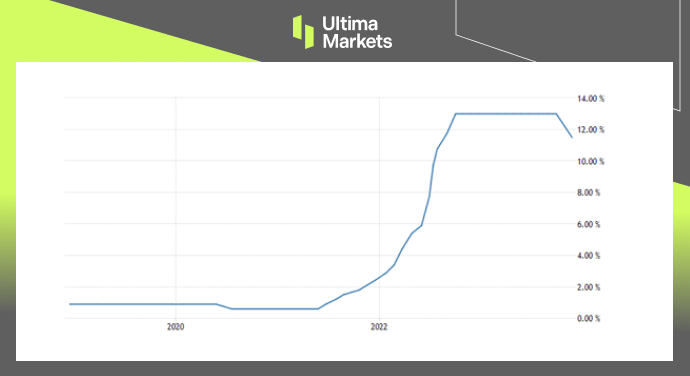

As Hungary’s inflation rate descended from its peak, the NBH responded with significant adjustments, slashing interest rates by a cumulative 650 basis points since May.

Despite these efforts, Hungary’s benchmark rate of 11.5% remains the highest among European Union members.

(Hungary Base Rate, National Bank of Hungary)

Core Inflation Challenges

While headline inflation witnessed a decline in October, core inflation persisted in double digits, posing challenges to the economic landscape. Notably, service prices surged by 13.2% annually, indicating robust underlying pressures amid a backdrop of recovering real wages.

Economic Outlook and Challenges

Despite the NBH’s proactive measures, Hungary’s economy faces potential stagnation or even recession in the current year. This sobering reality contradicts the government’s growth aspirations, highlighting the intricate dynamics at play in the nation’s economic landscape.

Future Interest Rate Cut Speculations

Looking ahead, there is speculation regarding a potential 75 basis points reduction at the December meeting, potentially bringing the base rate to 10.75%.

This aligns with both survey projections and the forecasts of key figures like Gyula Pleschinger, a member of the monetary policy council, who hinted at such a move in a Reuters interview back in September.

ทําไมต้องซื้อขายโลหะมีค่าและสินค้าโภคภัณฑ์กับ Ultima Markets?

Ultima Markets ให้บริการด้วยต้นทุนที่เหมาะสมแข่งขันได้ในสภาพแวดล้อมการซื้อขายที่ดีที่สุดสำหรับสินค้าที่เป็นที่นิยมแพร่หลายทั่วโลก

เริ่มการซื้อขายตรวจสอบความเป็นไปของตลาด

ตลาดมีความอ่อนไหวต่อการเปลี่ยนแปลงของอุปสงค์และอุปทาน

ดึงดูดนักลงทุนที่สนใจเฉพาะการเก็งกําไรราคา

สภาพคล่องที่สูงและหลากหลายโดยไม่มีค่าธรรมเนียมแอบแฝง

ไม่มี dealing desk และไม่มี requotes

การดําเนินการที่รวดเร็วผ่านเซิร์ฟเวอร์ Equinix NY4