Key Indicators and Market Impact Jobless Claim

Decline in Jobless Claims

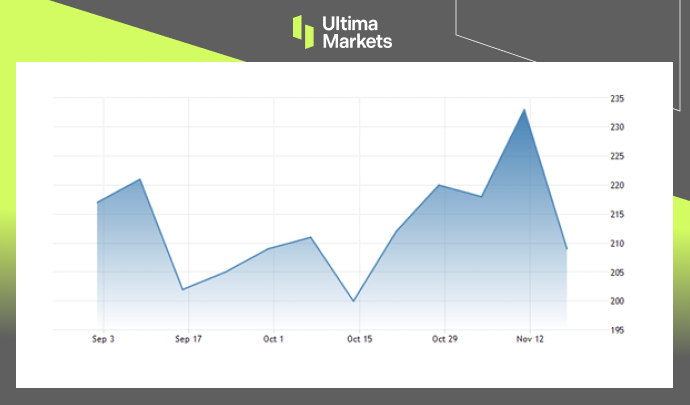

The United States Department of Labor’s most recent statistics shows a notable decrease in unemployment claims for the week ending November 18. Unemployment claims fell to 209,000, below market forecasts and reversing a three-month high from the week before.

Continuing claims, measuring ongoing unemployment, also plummeted by 22,000 to 1,840,000, rebounding from a two-year high reported in the last labor market update.

(Initial Jobless Claims, United States Department of Labor)

US Dollar Holds Gains

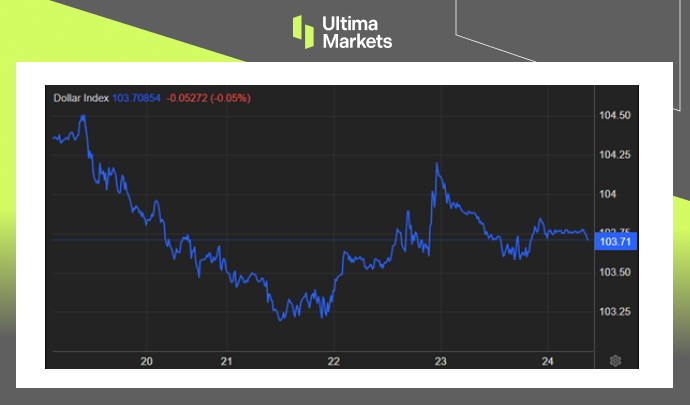

Simultaneously, the U.S. dollar showcased strength for a second consecutive session, propelling the dollar index above 104 levels. This resilience is noteworthy, especially during subdued market activity in Japan and the U.S. due to holiday periods.

Recent data suggests the Federal Reserve may not be inclined to cut interest rates in the near future, further supporting the dollar’s gains.

(Dollar Index Weekly Chart)

Inflation Expectations on the Rise

One-year-ahead inflation expectations surged to 4.5% in November, according to the University of Michigan’s final consumer survey reading. This 7-month high, up from preliminary estimates and October figures, contributes to the argument for maintaining current interest rate levels.

Federal Reserve’s Policy Implications

The positive jobless claims data indicates that the anticipated labor market slowdown has not materialized. Consequently, the Federal Reserve is likely to uphold its current stance on interest rates.

There’s a potential for further tightening in the future to fortify economic stability, reflecting the cautious approach to monetary policy.

Economic Outlook and Market Trends

Robust Jobless Claims and Labor Market Resilience

Despite concerns of a slowdown, robust jobless claims figures underscore the resilience of the U.S. labor market. This data showcases a workforce that continues to weather economic challenges, laying the groundwork for sustained economic growth.

Impact on Dollar Index and Global Rates

The dollar’s ascent, evident in the index surpassing the 104 levels, carries implications for global rates. The market’s perception of the Federal Reserve’s reluctance to cut interest rates contributes significantly to the dollar’s strength, influencing global economic dynamics.

Frequently Asked Questions

Q: How significant is the drop in jobless claims?

A: The drop of 24,000 in jobless claims is substantial, signaling a robust labor market and defying expectations.

Q: What does the rise in inflation expectations mean for the economy?

A: The increase in inflation expectations to 4.5% suggests growing confidence in economic stability, contributing to the dollar’s resilience.

Q: How might the Federal Reserve respond to these developments?

A: The Federal Reserve is likely to maintain its current stance on interest rates, with potential future tightening to support economic stability.

In conclusion, the recent decline in jobless claims and the dollar’s resilience paint a positive picture for the U.S. economy. The Federal Reserve’s careful monitoring of these developments will play a crucial role in shaping future monetary policy.

ทําไมต้องซื้อขายโลหะมีค่าและสินค้าโภคภัณฑ์กับ Ultima Markets?

Ultima Markets ให้บริการด้วยต้นทุนที่เหมาะสมแข่งขันได้ในสภาพแวดล้อมการซื้อขายที่ดีที่สุดสำหรับสินค้าที่เป็นที่นิยมแพร่หลายทั่วโลก

เริ่มการซื้อขายตรวจสอบความเป็นไปของตลาด

ตลาดมีความอ่อนไหวต่อการเปลี่ยนแปลงของอุปสงค์และอุปทาน

ดึงดูดนักลงทุนที่สนใจเฉพาะการเก็งกําไรราคา

สภาพคล่องที่สูงและหลากหลายโดยไม่มีค่าธรรมเนียมแอบแฝง

ไม่มี dealing desk และไม่มี requotes

การดําเนินการที่รวดเร็วผ่านเซิร์ฟเวอร์ Equinix NY4