Please note that this website is not intended for EU residents. If you are located in the EU and wish to open an account with an EU investment firm and protected by EU laws, you will be redirected to Huaprime EU Ltd, a company licensed and regulated by the Cyprus Securities and Exchange Commission with licence no. 426/23.

China’s Growth Slows; Third Plenum Targets Reform and Stimulus

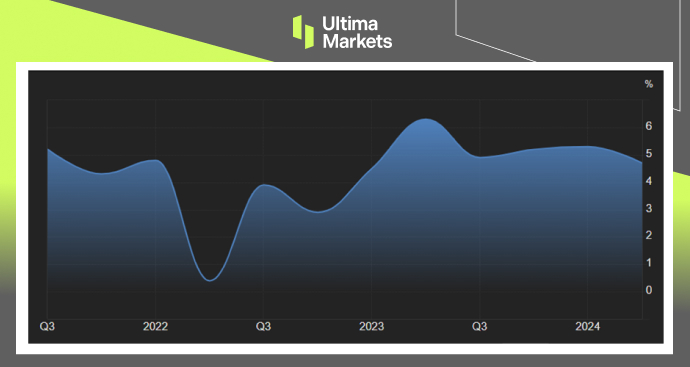

TOPICSIn Q2 2024, China’s GDP grew by 4.7% year-on-year, falling short of the 5.1% market forecast and decelerating from Q1’s 5.3% growth. This marks the slowest annual increase since Q1 2023, attributed to several factors: a persistent property market downturn, weak domestic demand, declining yuan value, and trade tensions with Western countries.

Despite these challenges, the economy expanded by 5.0% in the first half of 2024, aligning with the government’s annual growth target of around 5.0%. June’s economic indicators largely showed a slowdown, with retail sales growth hitting its lowest point in nearly 18 months and industrial output growth reaching a 3-month low. The urban unemployment rate remained steady at 5.0% for the third consecutive month.

On the trade front, exports surpassed expectations, while imports unexpectedly decreased. Amid these economic developments, the Chinese Communist Party commenced its Third Plenum, a crucial political event. The gathering is expected to introduce various reform measures and recommend additional support actions to stimulate economic recovery.

China’s central bank kept its medium-term lending rate at 2.5%, meeting market expectations. The move aims to support yuan stability amid ongoing economic challenges. The offshore yuan weakened beyond 7.27 against the dollar following China’s release of mixed economic indicators.

(China GDP YoY%,National Bureau of Statistics)

(USDCNY Weekly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Neden Ultima Markets ile Metaller ve Emtia Ticareti Yapmalısınız?

Ultima Markets, dünya çapında yaygın emtialar için en rekabetçi maliyet ve değişim ortamını sağlar.

Ticarete BaşlaHareket halindeyken piyasayı izleme imkanı

Piyasalar arz ve talepteki değişimlere duyarlıdır

Sadece fiyat spekülasyonu ile ilgilenen yatırımcılar için çekici

Derin ve çeşitli likidite ile gizli ücretler yok

Dealing desk yok ve yeniden fiyatlandırma yok

Equinix NY4 sunucusu üzerinden hızlı yürütme