Australia Inflation Cools in February, Boosting RBA Rate Cut Bets

TOPICSTags: AUDUSD, Australian Dollar, CPI, Inflation, Interest Rate, RBA

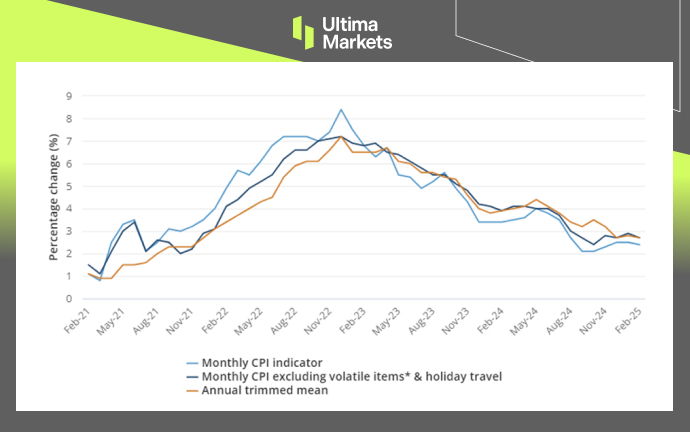

Australia’s Consumer Price Index (CPI) came in lower than expected in February, with both headline and underlying inflation slowing from the previous month. This has further fueled market expectations of potential rate cuts by the Reserve Bank of Australia (RBA).

- Headline Inflation rose 2.4% YoY in February (vs. 2.5% expected).

- Underlying Inflation (excluding volatile items) increased 2.7% YoY, down from 2.8% in January.

(Australian Monthly CPI Indicator; Source: Australian Bureau of Statistics)

This softer inflation print follows last week’s data, which showed signs of weakening in the Australian labor market. Together, these factors are strengthening expectations for future monetary easing by the RBA.

RBA April Meeting: No Rate Cut Expected?

With February inflation continuing its disinflationary trend and signs of a slowing labor market, expectations for an RBA rate cut have increased. However, a cut is unlikely in April.

After the initial rate cut in February, the RBA maintained a slightly hawkish stance, emphasizing a cautious approach to further easing. Policymakers have highlighted ongoing economic uncertainties and a still-resilient labor market, signaling that additional cuts will depend on data aligning with their projections.

Although monthly CPI indicators show progress, the RBA typically bases its decisions on quarterly CPI data, which will be released on April 30.

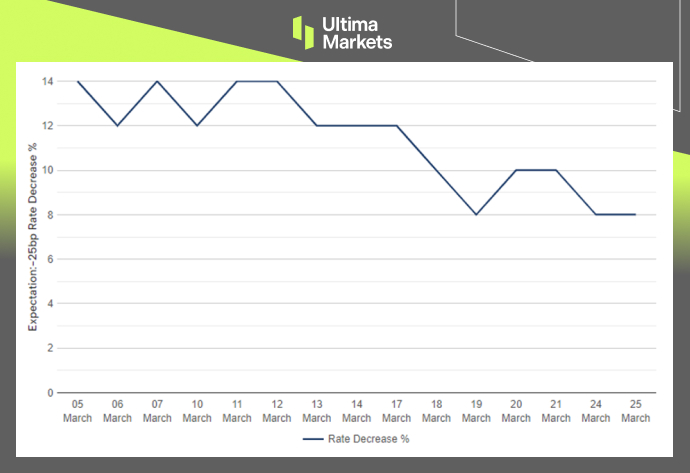

According to ASX Rate Tracker, Cash Rate Target Implied Expectation of change show only 8% of rate cut is likely in April meeting, while 92% see no changes.

(ASX RBA Rate Tracker; Source: ASX Official Site)

“Given the central bank’s tone, back-to-back rate cuts are unlikely until after the April 30 CPI release. The earliest possible cut could come at the May 20 meeting,” said Ultima Markets Senior Analyst Shawn.

Market Reaction: Australian Dollar’s Dip May Be Short-Term

The Australian dollar fell nearly 0.5% against the U.S. dollar following the CPI release but quickly recovered its losses afterward.

(AUDUSD, 1-H Chart; Source: Ultima Markets MT5)

Currently, AUD/USD is trading near 0.6300, with recent price action staying within the 0.6320–0.6260 range. Lack of major catalysts has kept the pair in consolidation, and a significant move may only occur after the RBA meeting next week or if market sentiment shifts due to Trump’s “Reciprocal Tariff” policy set to take effect in April.

As a risk-sensitive currency, the Australian dollar remains vulnerable to changes in global trade dynamics.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server