U.S. Dollar Rallies on Robust Employment Data

TOPICSTags: NFP, Rate Cut, Unemployment Rate, US dollar

The dollar strengthened last Friday after a U.S. jobs report revealed the largest increase in employment in six months for September, accompanied by a decline in the unemployment rate and notable wage growth. These signs of a resilient economy led markets to dial back expectations for Federal Reserve rate cuts. The U.S. dollar index climbed 0.54%, closing at 102.49.

(U.S Dollar Index Daily Price, Source: Trading View)

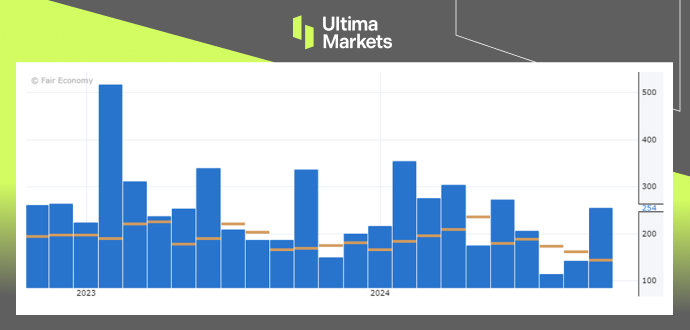

According to the U.S. Bureau of Labor Statistics, 254,000 jobs were added to nonfarm payrolls in the past month, surpassing economists’ projection of 140,000. The unemployment rate came in at 4.1%, lower than expected of 4.2%.

(U.S Non-Farm Employment Change, Source: Forex Factory)

Investors’ response to this impressive job growth underscores their focus on economic expansion, even when it coincides with a more hawkish stance. As a result, traders now anticipate a roughly 97% chance that the Fed will reduce rates by only a quarter percentage point in November, up from around 68% on Thursday, as shown by CME Group’s Fed Watch tool.

Additionally, despite the ongoing concerns about geopolitical developments and the risk of an energy supply disruption, market participants with risk-on positions have not faced any significant market-shifting news over the weekend and are entering the new week with confidence in further gains. In the latest updates from the Middle East, Israel launched airstrikes on Hezbollah targets in Lebanon and the Gaza Strip on Sunday, with Israel’s defence minister stating that all options for retaliation against Iran were on the table.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server