You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Huaprime EU Ltd duly licensed and regulated by the Cyprus Securities and Exchange Commission.

U.S. Dollar Rises Despite Rate Cut Bets Amid Sticky Inflation Data

TOPICSInflation Remains Sticky, in Line with Expectations

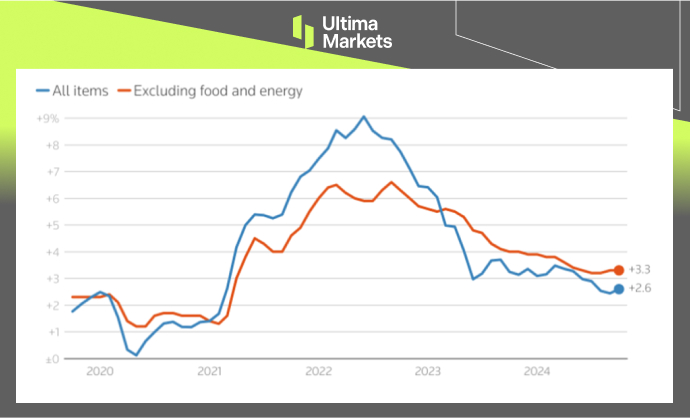

On Wednesday, the Bureau of Labor Statistics reported that the Consumer Price Index (CPI) increased by 0.2% for the fourth consecutive month, aligning with economists’ expectations in a Reuters poll. Year-over-year, the CPI rose by 2.6% through October, up from 2.4% in September, also meeting forecasts. Following the report, the U.S. Dollar Index rose by 0.49%, closing at 106.48.

(U.S. CPI y/y and Core CPI y/y Chart, Source: LSEG)

(DXY Daily Price Chart, Source: Trading View)

The CPI data, especially the uptick in the 12-month rate, suggests that although the Fed is widely expected to reduce rates by 25 basis points at its December meeting, persistently high inflation could prompt a reassessment of its pace of easing in 2025. Since September, the Fed has implemented a total of one percentage point in rate cuts.

After the release, traders’ bets indicated an 82% probability of a 25 basis-point cut in December, up from 58.7% on Monday, according to CME Group’s FedWatch tool. While some Fed officials took a more cautious tone, Minneapolis Fed President Neel Kashkari expressed confidence that inflation was on a downward trend, noting the CPI data aligns with this trajectory.

However, significant uncertainty persists, especially given potential policy changes post-election. The market is making many assumptions about future policy direction, yet it remains uncertain where things will stand over the next one to two years.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server