Focus on Brent Oil today.

Fundamentally, with OPEC and EIA predicting that production cuts will tighten the market in the coming months, Brent crude oil has finally returned to above $90. The International Energy Agency will also release its monthly report today, which is expected to provide more clues to market conditions. The market focuses on whether the report also emphasizes that crude oil production will tighten supply for the rest of this year.

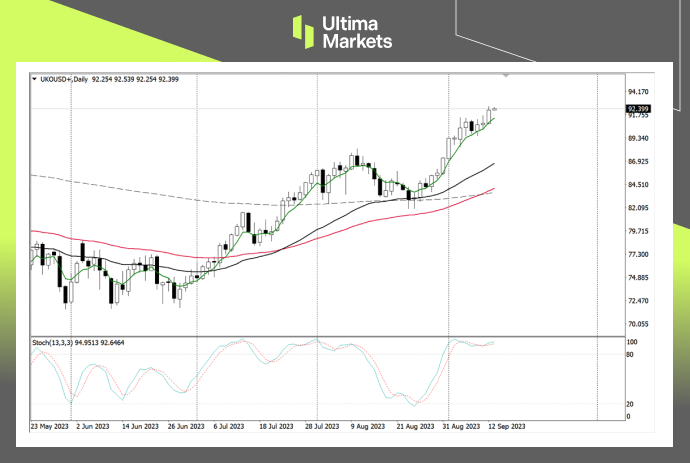

Technically, the stochastic oscillation in daily chart has once again risen with a golden cross, indicating the arrival of bulls. The moving average group also raised their heads to support the market’s further upward trend.

( Daily chart of Brent Oil, source: Ultima Markets MT4)

There is currently no moving average suppression above crude oil, and there is little resistance for bulls. Although the current signal of the stochastic oscillator occurs in the overbought area, judging from the chart, even if the market declines again, it will still have the support of the moving average group.

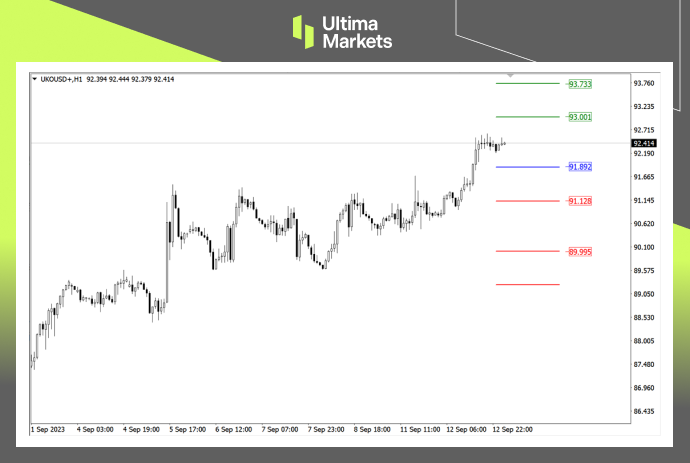

(1-hour chart of Brent Oil, source: Ultima Markets MT4)

On the 1-hour period, crude oil finally broke through resistance and moved upward yesterday after oscillating for nearly 5 trading days. At present, the stochastic oscillator crosses downwards, and the market has a potential adjustment probability in the Asian market. Priority is given to the resistance level for breakthroughs. After waiting for the stochastic oscillator to cross again, traders can pay attention to the long entry opportunities.

(1-hour chart of Brent Oil, source: Ultima Markets MT4)

According to the pivot indicator in Ultima Markets MT4, the central price of the day was 91.892.

Bullish above 91.892, first target 93.001, second target 93.733

Bearish below 91.892, first target is 91.128, second target is 89.995

Disclaimer

Comments, news, research, analysis, prices and other information contained in this article can only be regarded as general market information, provided only to help readers understand the market situation, and do not constitute investment advice. Ultima Markets will not be responsible for any loss or loss (including but not limited to any loss of profits) that may arise from the direct or indirect use or reliance on such information.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server