9.7 Metal Daily XAU/USD

TOPICSFocus on XAU/USD today.

Fundamentally, yesterday the United States released ISM data on the service industry, just like the market outlook shared on Monday. The Fed is currently looking for data support. Consumption is one of the three economic carriages in the United States. The good performance of the ISM service industry PMI will greatly stimulate the bullish trend of the US dollar. The PMI data unexpectedly strengthened in August to 54.5, reflecting sustained strength in consumer demand and the overall economy and strengthening hopes that the United States can avoid recession. It also brings potential signs that inflation will still rise, and the dollar will maintain a certain bullish trend until the data is digested this week.

Technically, the gold finally fell below the 33-day and 7-day moving average yesterday, and the market’s short trend is relatively clear.

(Daily chart of XAU/USD, source: Ultima Markets MT4)

The stochastic oscillator also sent a short signal, and the market on the daily chart has a probability of going back to the moving average lines during the Asian session.

(4-hour chart of XAU/USD, source: Ultima Markets MT4)

On the 4-hour chart, after the market peaked and fell below the neckline this week, the moving average lines subsequently made a dead cross which is kind of short signal. It is worth noting that the stochastic oscillator currently indicates that the market is about to bottom out, and there is a certain probability of rebound or consolidation.

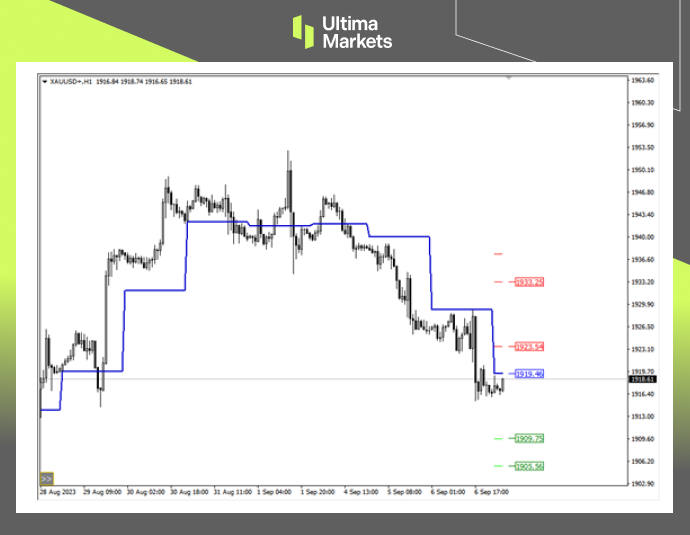

(1-hour chart of XAU/USD, source: Ultima Markets MT4)

According to the pivot indicator in Ultima Markets MT4, the pivot of the day was 1919.46.

Bullish above 1919.46, the first target is 1923.54, and the second target is 1933.25

Bearish below 1919.46, the first target is 1909.75, the second target is 1905.56

Disclaimer

Comments, news, research, analysis, prices and other information contained in this article can only be regarded as general market information, provided only to help readers understand the market situation, and do not constitute investment advice. Ultima Markets will not be responsible for any damage or loss (including but not limited to any loss of profits) that may arise from the direct or indirect use or reliance on such information.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server