Australia’s Central Bank Maintains Rates but Reduces Hawkish Tone

TOPICSOn Tuesday, Australia’s central bank reaffirmed that rate cuts are unlikely in the short term, keeping its policy rate steady at 4.35%. However, it eased its hawkish tone by indicating that further monetary tightening was not on the agenda. Governor Michele Bullock noted that while the board didn’t actively consider a rate hike, they did review whether their hawkish communication needed adjustment.

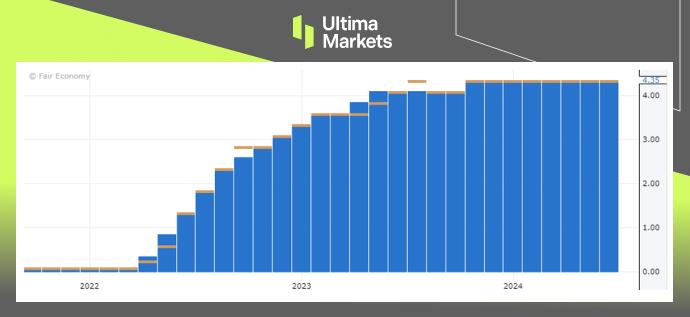

(Reserve Bank of Australia Cash Rate, Source: Forex Factory)

The policy will remain restrictive until the Board is assured that inflation is on a sustainable path towards its target range. Market participants had largely expected a steady decision, considering that core inflation remains persistently high, and the labour market continues to perform robustly. With core inflation stuck at 3.9% last quarter and strong job creation, there seems to be no rush for policy easing, unlike the Federal Reserve’s move last week, cutting rates by 50 basis points to preempt potential job losses.

The RBA is lagging behind other central banks in reducing rates, and political pressure is growing for a shift towards easing. Additionally, the Australian Dollar reached multi-month highs as China’s aggressive stimulus package bolstered risk sentiment. Global markets were uplifted by China’s latest suite of support measures, which included significant rate cuts and stock market support, boosting investor confidence.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server