Australia’s Inflation Rate Falls Sharply to 42-Month Low

TOPICSTags: Australia, CPI index, gasoline prices, inflation rate, RBA

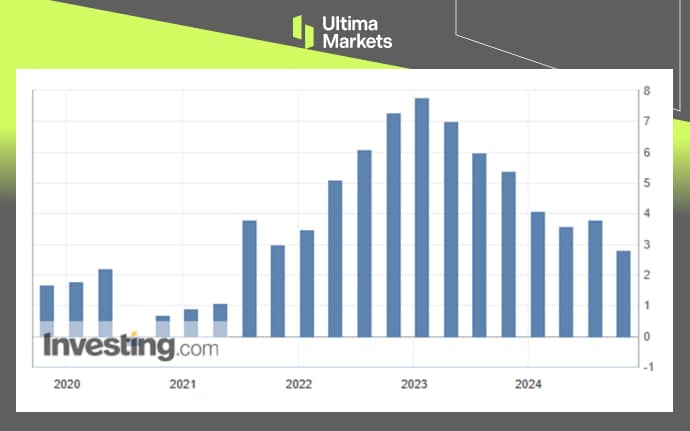

Australia’s Q3 CPI Eases to RBA Target Range

On Wednesday, the Australian Bureau of Statistics reported that the consumer price index (CPI) rose by just 0.2% in the third quarter, slightly below the expected 0.3% increase. Annual inflation slowed to 2.8% from 3.8%, marking the first time since late 2021 that inflation has fallen within the Reserve Bank of Australia’s (RBA) target range of 2%-3%.

(Australia CPI YoY Q3 Data, Source: Investing.com)

This decline may have been influenced by government rebates on electricity and a reduction in gasoline prices, while a drop in core inflation has strengthened the potential case for a rate cut in the future. The RBA’s preferred core inflation measure, the trimmed mean, rose 0.8% for the quarter, slightly above forecasts of a 0.7% increase, bringing the annual pace down to 3.5% from 4.0%. However, inflation in the services sector remains elevated.

The RBA has kept rates steady since November, maintaining the cash rate at 4.35%, up from a pandemic-era low of 0.1%. The central bank considers this rate sufficiently restrictive to guide inflation back into its 2%-3% target range while supporting employment. Economic growth has slowed under the pressure of high interest rates, yet underlying inflation remains stubborn, with only gradual easing in the labor market. This has led markets to price in just a 26% chance of a rate cut by December.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server