Crude oil prices: The Red Sea attack

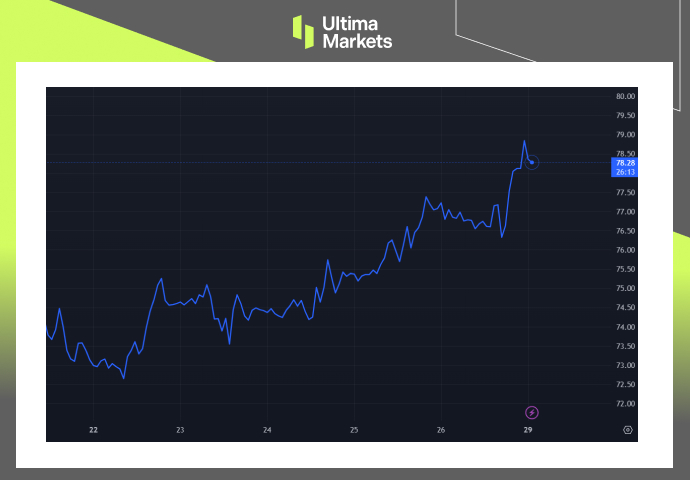

WTI oil price on Monday.

Crude oil prices rose more than 1% on Monday after Houthi movement launched an attack on a fuel tanker in the Red Sea. Commodities trader Trafigura released a statement on risk assessment on Saturday, noting possible oil supply disruption following the attack last Friday.

With oil tankers linked to US and UK being under siege for passing through the Red Sea, investors are likely to reassess their view upon oil market through its current fundamentals.

Russia’s Crude oil output may face disruption.

Last week, Russian Rosneft oil refinery in Krasnodor Krai was attacked by Ukraine’s drone, and the latter retaliated by attacking energy infrastructure. The refinery was strategically planned as it is located a few miles off the border with Ukraine.

Although Russia is being sanctioned by the US, it is likely to jeopardize the country’s export and production due to possible sanction evasion.

OPEC set to meet in February.

Organization of the Petroleum Exporting Countries (OPEC) and its allies led by Russia (known as OPEC+) will be meeting on 1st February, via online to discuss oil production levels for coming months.

According to a few sources, the committee is likely to keep their existing policy unchanged for the time being. In addition, the source also noted that it is too early to make decision on further cuts following last round of reduction in November 2023. Moreover, rising geopolitical tension in Middle East may cloud future outlook, which hence requires more time to assess the fundamentals.

Frequently Asked Questions

Q: Why does crude oil price rise?

A: Crude oil price rose due to recent geopolitical tension in the Middle East, specifically attacks on oil tankers and cargo in the Red Sea that could reduce oil supply for short-term.

Q: Will OPEC cut their production further?

A: It is still unclear for the time being due to rising geopolitical tension in the Middle East, which may indirectly support crude oil prices in the short-term.

Q: Where can I get updates for OPEC+ meeting?

A: You can obtain latest news and updates via Organization of Petroleum Exporting Countries’ official website.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server