ECB Deliver Another Cuts, Fed Awaits Clarity

TOPICSOn April 17, the European Central Bank (ECB) announced a 25-basis point cut in its key interest rates as widely expected, marking the seventh cut since June 2024. This decision lowers the deposit facility rate to 2.25%, the main refinancing operations rate to 2.40%, and the marginal lending facility rate to 2.65%.

The further cuts aims to support the eurozone economy amid escalating global trade tensions, particularly the recent tariffs imposed by the United States.

ECB Remains Data-Dependent

ECB President Christine Lagarde emphasized that the rate cut was a unanimous decision, reflecting concerns over the negative demand shock caused by the U.S. tariffs. She noted that these trade tensions are likely to dampen exports, investment, and consumption within the euro area.

Lagarde also highlighted that while inflation has been declining and is near the ECB’s 2% target, the outlook for growth has deteriorated due to increased uncertainty from global trade policies.

On the April meeting, the ECB did not path out the future policy path after its seventh consecutive cut. The ECB’s approach remains data-dependent, with future policy decisions to be made on a meeting-by-meeting basis, considering the evolving economic and financial data.

Fed’s Powell: Tariff Impact Larger Than Expected

Federal Reserve Chair Jerome Powell, speaking at the Economic Club of Chicago on Thursday, addressed the growing concerns surrounding the U.S. economic outlook amid intensifying trade tensions.

Powell noted that the recently imposed tariffs by the Trump administration are “significantly larger than anticipated,” raising concerns over their potential to push inflation higher and slow down economic growth. He emphasized that while the Fed remains committed to its dual mandate, it is prepared to adjust monetary policy if necessary.

“We will proceed cautiously,” Powell said, adding that the Fed will wait for more clarity on the full economic impact of the tariffs before making any firm interest rate decisions.

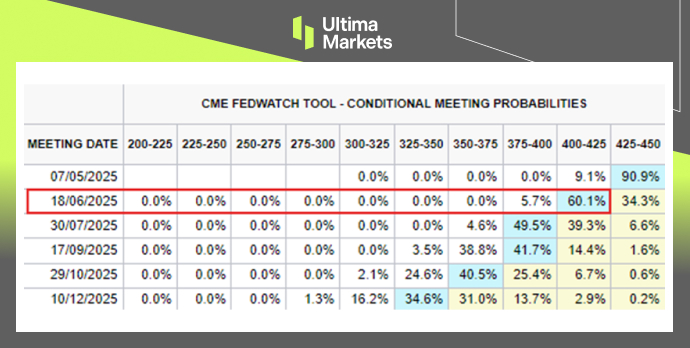

This cautious stance leaves the door open for a potential rate cut in the coming months, especially if inflation remains stable and economic data softens. With two to three inflation reports ahead of May or June meeting, markets are increasingly anticipating that the Fed may move toward easing in June if economic data allows.

(CME Fedwatch Tool – Meeting Probabilities; Source: CME Group)

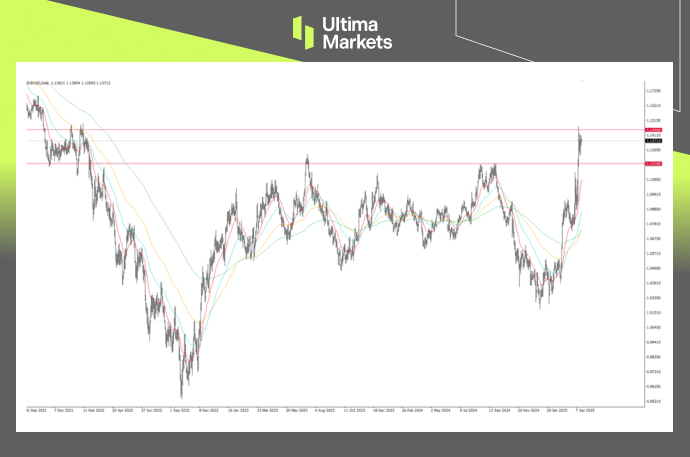

EURUSD Tests Multi-Year High

(EURUSD, Day Chart; Source: Ultima Market MT5)

EURUSD is currently trading near its 3-year high around the 1.1400 level, facing resistance around the February 2022 peak.

From a technical standpoint, this zone could act as a short-term barrier. However, a confirmed breakout above 1.1400—and especially if the pair sustains above 1.2100 in the coming sessions—would reinforce a bullish outlook for the euro.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server