Japan Tokyo CPI Accelerates to Two-Year High, BoJ Meeting Ahead

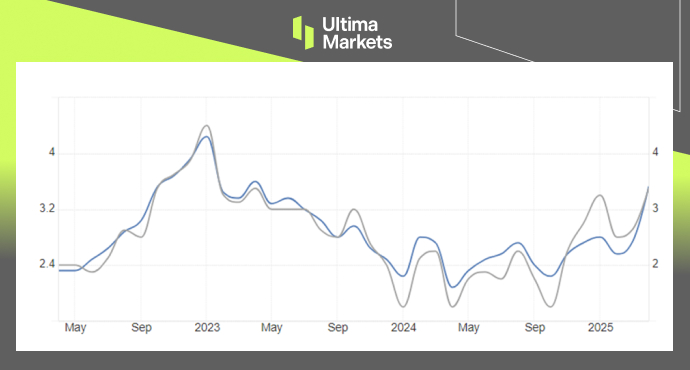

TOPICSTokyo’s Core Consumer Price Index (CPI) jumped to a two-year high in April 2025, rising 3.4% year-on-year and surpassing market expectations of 3.2%. This marks the first time since July 2023 that core inflation has exceeded 3%.

Meanwhile, the Tokyo Headline CPI rose 3.5% in April, up from 2.9% in March.

(Tokyo CPI and Core CPI; Source: Statistics Bureau of Japan | TradingEconomic)

The increase was largely driven by a reduction in government subsidies for electricity and gas, alongside a wave of food price hikes that took effect on April 1, coinciding with the start of Japan’s new fiscal year.

Bank of Japan Meeting Ahead

The latest Tokyo CPI data points to rising inflationary pressures, aligning with the upward trend seen in recent national CPI figures. As Tokyo CPI is often viewed as a leading indicator of broader price trends across Japan, the data has drawn increased attention.

This comes just ahead of the Bank of Japan’s policy meeting on May 1, where the central bank is widely expected to keep its benchmark interest rate unchanged at 0.5%.

While the BoJ has previously signaled a more hawkish stance—indicating readiness to raise rates further—the path forward is becoming more complex. The recent surge in inflation, coupled with the uncertainties stemming from sweeping U.S. tariffs, has made the timing and pace of future hikes remains uncertain.

The Complication for BoJ

Rising price pressures and a rebound in consumer spending have pushed the Bank of Japan to end its decade-long ultra-loose monetary policy, beginning with its first rate hike in March 2024. Since then, the central bank has maintained a hawkish tone to tackle inflation and steer away from the long-standing deflation risks.

However, the sweeping U.S. tariffs have added a fresh layer of uncertainty over Japan’s economic outlook—creating a challenge for the BoJ as it considers its next move.

Japanese Yen May Correct?

Investors now expect the Bank of Japan (BoJ) to lower its economic growth forecasts due to growing risks from U.S. tariffs. This may lead the BoJ to delay further interest rate hikes, causing the Japanese yen to weaken against major currencies after the recent inflation data.

The U.S. dollar extended its gains against the yen after bouncing from the key psychological level of 140. While the broader trend remains downward, a short-term rebound is possible as investors bet the BoJ may hold off on more rate hikes due to global uncertainties.

USDJPY, 4-H Chart Analysis; Source: Ultima Market MT5

However, if price pressures continue, the Bank of Japan may stay hawkish. If the BoJ confirms this stance at the upcoming May meeting, the Japanese yen could strengthen again.

Technically, USDJPY may continue its short-term rebound if it holds above 142.00. However, the broader trend remains bearish unless the pair breaks above the key resistance at 146.50. A clearer market direction is likely to appear after the BoJ’s policy announcement.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server