Hungary’s Recent Benchmark Interest Rate Cut and Economic Dynamics

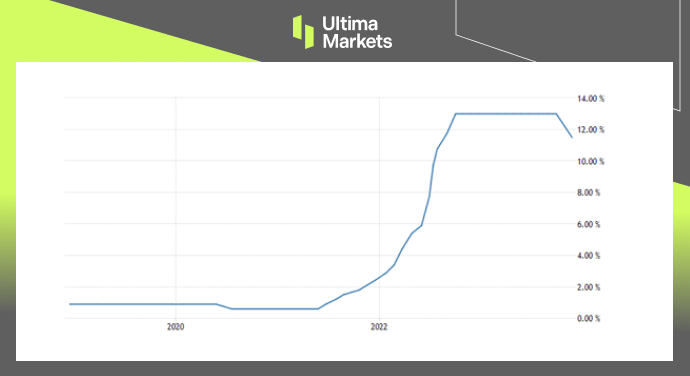

In a decisive move on November 21, the National Bank of Hungary (NBH) implemented a 75 basis points reduction in the benchmark interest rate, bringing it to 11.5%.

This strategic decision, made amidst pressure for further rate cuts from the government, reflects the delicate balance between stimulating economic growth and maintaining cautious monetary policies.

Hungary’s Inflation Dynamics

Hungary currently grapples with the highest inflation rate in the European Union. Initially peaking at a staggering 25% in the first quarter, inflation has gradually eased to 9.9% last month, defying earlier forecasts.

Despite this decrease, the NBH remains vigilant, emphasizing a gradual approach to rate adjustments.

NBH’s Response to Inflation Trends

As Hungary’s inflation rate descended from its peak, the NBH responded with significant adjustments, slashing interest rates by a cumulative 650 basis points since May.

Despite these efforts, Hungary’s benchmark rate of 11.5% remains the highest among European Union members.

(Hungary Base Rate, National Bank of Hungary)

Core Inflation Challenges

While headline inflation witnessed a decline in October, core inflation persisted in double digits, posing challenges to the economic landscape. Notably, service prices surged by 13.2% annually, indicating robust underlying pressures amid a backdrop of recovering real wages.

Economic Outlook and Challenges

Despite the NBH’s proactive measures, Hungary’s economy faces potential stagnation or even recession in the current year. This sobering reality contradicts the government’s growth aspirations, highlighting the intricate dynamics at play in the nation’s economic landscape.

Future Interest Rate Cut Speculations

Looking ahead, there is speculation regarding a potential 75 basis points reduction at the December meeting, potentially bringing the base rate to 10.75%.

This aligns with both survey projections and the forecasts of key figures like Gyula Pleschinger, a member of the monetary policy council, who hinted at such a move in a Reuters interview back in September.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server