RBNZ Cut by 50 Bps as Widely Expected

TOPICSTags: Central Bank, interest rate decision, NZDUSD, RBA

RBNZ Cut by 50 Bps as Widely Expected

Early today, the Reserve Bank of New Zealand (RBNZ) reduced the Official Cash Rate (OCR) by 50 basis points as widely expected, bringing it to 3.75%. This decision marks the third consecutive half-percentage-point cut since August 2025, aimed at stimulating the economy and employment.

In its policy statement, the RBNZ’s Monetary Policy Committee noted that headline inflation remains near the 2% midpoint, with core inflation continuing to decline toward the target. The Committee expressed confidence that the current economic outlook supports keeping inflation within the target range over the medium term, allowing for continued easing of the OCR through 2025.

Governor Orr: Lower OCR Further Through 2025

Governor Orr highlighted that while domestic inflationary pressures are easing due to spare productive capacity, global economic uncertainties—such as geopolitical tensions and potential trade barriers—pose risks to the economic outlook. The RBNZ remains prepared to adjust monetary policy further if economic conditions evolve as projected.

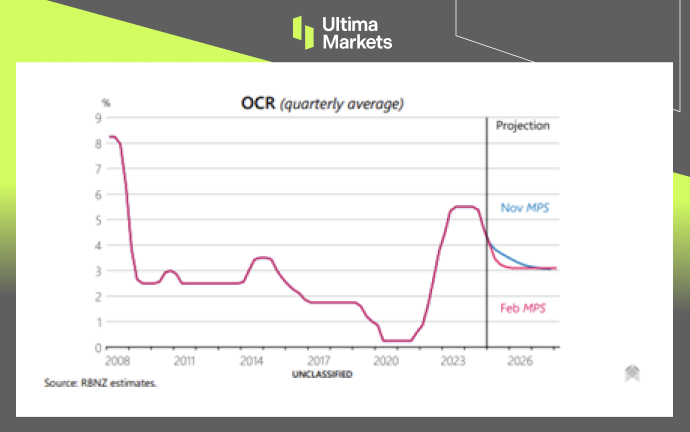

(RBNZ OCR Rate Projection, Source: RBNZ)

The projected Official Cash Rate (OCR) trajectory, represented by the pink line in the February Monetary Policy Statement (MPS), suggests a slightly more aggressive rate-cutting approach. The OCR is expected to fall to 3% by the end of 2025, implying an additional 75 basis points in cuts.

While the projection does not specify exact meeting dates for future cuts, the slope of the forecasted trajectory suggests the next rate cut could occur sometime between mid-to-late 2025, depending on economic conditions. This aligns with Governor Orr’s comments that further easing remains a possibility if inflation continues to decline.

Technical Outlook for NZDUSD Chart

(NZDUSD 4-H Chart Analysis, Source: Trading View)

The NZD/USD initially declined following the dovish RBNZ decision, but the losses were quickly erased.

From a technical standpoint, the overall setup for NZD/USD remains unchanged. The pair recently broke out of a consolidation zone near a three-year low, signaling a potential bullish reversal. This outlook is further supported by its ability to hold above the 0.5690 (0.5700) resistance-turned-support level.

If 0.5690 holds, it could indicate that the market has fully priced in the RBNZ’s dovish stance. Additionally, recent U.S. dollar weakness could further support upside momentum for the pair.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server