SNB Cuts Interest Rates Once More, Franc Takes a Breather

TOPICSTags: SNB, Swiss franc, Switzerland, USD/CHF

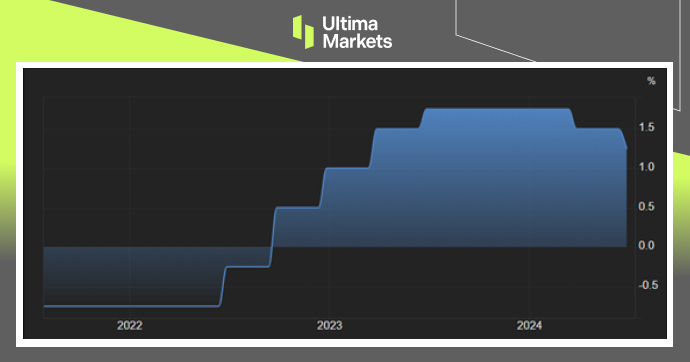

In June 2024, the Swiss National Bank (SNB) decided to lower the primary policy rate by 0.25 percentage points, settling it at 1.25%. Such action aligned with the financial market’s expectations and mirrored the bank’s previous move at its earlier meeting. The decision stemmed from a diminishment in the core inflation pressures and the robustness of the Swiss franc. With the rate adjustment, the SNB aims to preserve monetary conditions suitable for the current economic landscape. At that time, the main inflationary force in Switzerland was the rise in domestic service prices.

Regarding the SNB’s forecasts, assuming the policy rate stays at 1.25%, the bank projects an annual inflation rate averaging 1.3% for 2024. It is then expected to decrease slightly to 1.1% in 2025 and further diminish to 1.0% in 2026. These projections match those made in March.

Economically, the SNB exhibits optimism but maintains a cautious stance, expecting a modest increase in the Gross Domestic Product (GDP) by about 1% in 2024 and an improvement to 1.5% in 2025. The bank also forecasts a minor upswing in the unemployment rate and envisions standard levels of production capacity utilization during this period.

Prior to the monetary policy adjustment, the Swiss franc was significantly appreciating in value, trading close to its 3-month peak against the U.S. dollar and 4-month highs against the euro. Such a surge in value was largely due to political unrest in France, including the ascension of far-right groups in the European Parliament elections, prompting investors to seek the traditionally seen safe asset of the Swiss franc.

After the SNB’s announcement, the Swiss franc depreciated by approximately 0.5%, nearing 0.89 against the US dollar.

(Historical Interest Rates,Swiss National Bank)

(USD/CHF Monthly Chart)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server