Trump Announces 25% Tariffs on EU, Fed Maintains Restrictive Policy

TOPICSTags: Federal Reserve, monetary policy, Trump, Trump Tariffs

Trump Slaps 25% Tariffs on EU, Fed Holds Restrictive Policy

The market on Wednesday turned its attention to the latest statements from Federal Reserve officials and U.S. President Donald Trump, who, in his first official cabinet meeting of his second term, vowed to impose 25% tariffs on European Union (EU) imports, escalating global trade tensions.

Trump Threatens 25% Tariffs on EU Goods

On February 26, 2025, President Trump announced plans to impose a 25% tariff on imports from the European Union, claiming that the EU was “formed to screw the United States.” While he did not provide specific details, the decision has escalated the global trade tensions.

In response, the European Commission swiftly condemned the move, warning that it would “react firmly and immediately” to what it considers unjustified trade barriers. The prospect of EU retaliation has added to market uncertainty.

Uncertainty Over Canada and Mexico Tariffs

Beyond the EU tariffs, Trump also addressed the previously announced 25% tariffs on imports from Canada and Mexico. Initially scheduled to take effect on March 4, confusion now surrounds their implementation. While Trump hinted at a possible delay to April 2, a White House spokesperson later insisted that the original timeline remains unchanged. Both Canada and Mexico have expressed intentions to impose retaliatory measures if the tariffs proceed.

Fed Officials Maintain Restrictive Policy Stance

Meanwhile, Federal Reserve officials Raphael Bostic and Tom Barkin reiterated their cautious stance on monetary policy in their latest statements:

- Raphael Bostic (Atlanta Fed President): Bostic noted that while the U.S. economy remains strong, uncertainties persist. He emphasized that interest rates should remain in restrictive territory until there is clear evidence of inflation returning to the 2% target.

- Tom Barkin (Richmond Fed President): Barkin echoed a cautious approach, stressing the need to wait and assess how current economic uncertainties evolve before making any significant monetary policy adjustments.

The hawkish tone from Fed officials reinforces expectations that the central bank will maintain higher interest rates for longer, potentially weighing on risk assets

Market Implications: S&P 500 Futures Extend Losing Streak

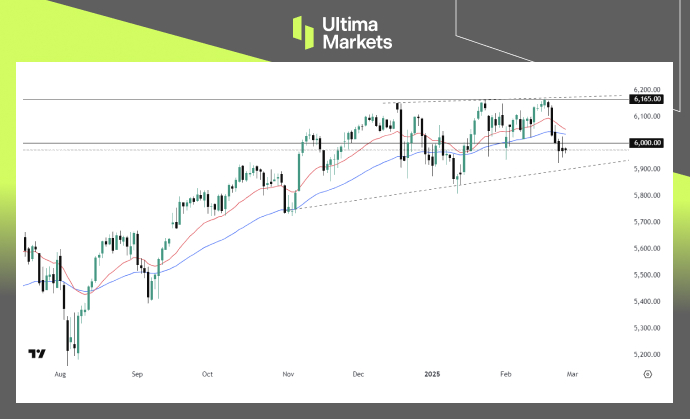

The combination of heightened trade tensions and the Fed’s restrictive stance has fueled volatility across financial markets. S&P 500 futures failed to reclaim the 6,000-mark, despite early-session attempts to climb higher, marking five consecutive days of losses.

(S&P500 Futures, Daily Chart; Source: Trading View)

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server