Trump’s Auto Tariffs Shake Markets, U.S. Indices Plunge

TOPICSMajor U.S. stock indices tumbled following President Trump’s announcement of new auto import tariffs. Technology stocks, including Nvidia and Tesla, saw significant declines, contributing to the overall market sell-off.

Trump Announces 25% Auto Tariffs

On Wednesday, President Trump confirmed plans to impose a 25% tariff on imported vehicles not manufactured in the U.S., set to take effect on April 2.

While the full details are still being released, current reports indicate that the 25% tariffs will apply to finished vehicles in addition to existing duties. Furthermore, tariffs on major automotive parts imports are expected to follow, with implementation no later than May 3.

The new trade measures are expected to have a significant impact on major auto-exporting nations, including Japan, South Korea, and European Union members such as Germany and Italy, which is a close trade partners of the U.S.

Investor Sentiment Turns

The introduction of new auto tariffs has heightened the concerns about a potential trade tension, which has been eased slightly over the past two weeks.

Shares of major automakers saw sharp declines, with General Motors and Ford posting notable losses, while Asian automakers, including Toyota, also faced selling pressure.

Beyond the auto sector, the tariffs triggered a broader market sell-off, dragging down Dow Jones, S&P 500, and Nasdaq futures.

Meanwhile, Canadian leaders have strongly criticized the tariffs and pledged a swift response to safeguard their automotive industry. Other key auto-exporting nations, including Japan, South Korea, and Germany, are evaluating potential retaliatory measures and voicing concerns over worsening trade relations.

Nasdaq Slips Below 20,000, SP500 Hold Below Resistance

The tech-heavy Nasdaq 100 retreated after gaining for three consecutive days, falling below the key 20,000 psychological level on Wednesday.

(NAS100, Daily Chart; Source: Ultima Markets MT4)

From a technical perspective, despite recent rebounds, Nasdaq 100 has remained below 20,600—a level signaling bearish sentiment. If market concerns over tariffs and potential retaliatory measures persist, the index could face further downside pressure.

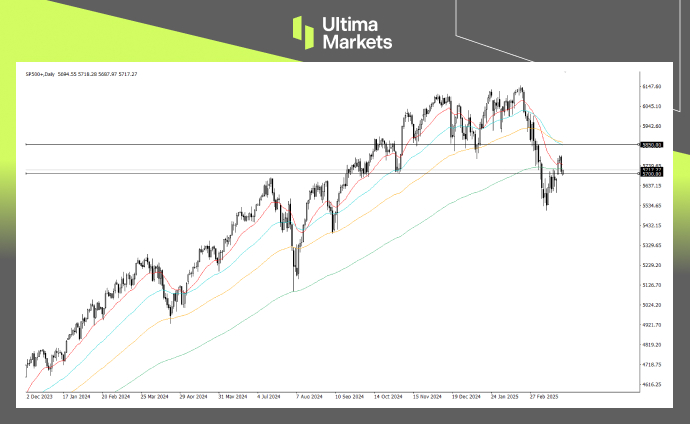

(SP500, Daily Chart; Source: Ultima Markets MT4)

Meanwhile, the SP500 remains in a bearish zone, fluctuating around its 200-day moving average. The 5700–5850 range serves as a key level, with a break below 5700 likely signaling further downside momentum.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server