U.S. Dollar Rallies as Stronger CPI Data Ignites Market Optimism

TOPICSTags: CPI, FED, Interest Rate, US dollar

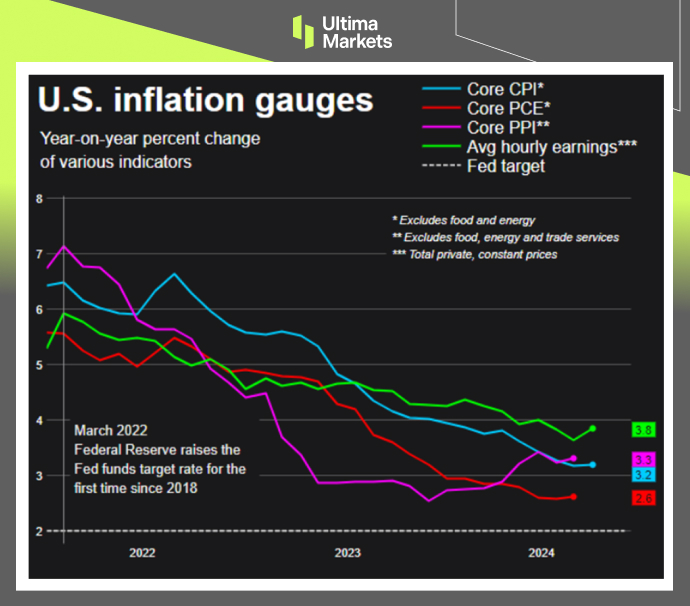

On Wednesday, the data revealed that the U.S. Consumer Price Index (CPI) rose by 0.2% last month, mirroring the increase seen in July. Over the past 12 months ending in August, the CPI grew by 2.5%, marking the slowest annual increase since February 2021 and down from the 2.9% gain in July. However, when excluding the more volatile food and energy categories, the core CPI rose by 0.3% in August, following a 0.2% increase in July, slightly surpassing the expected 0.3% rise.

(U.S Inflation data, Source: LSEG Data stream)

This data significantly reduces the probability of a 50-basis-point rate cut from the Federal Reserve in next week. This outcome was anticipated, as the market’s expectations for such a large rate cut in September seemed overly optimistic. The Fed’s focus remains on labour market data, making employment numbers and their revisions even more crucial.

With expectations of a smaller 25 bps cut instead of 50 bps, market sentiment appears somewhat cautious. A minor correctional bounce for the dollar is anticipated in September, followed by a renewed weakening toward the end of 2024 and into 2025. However, markets have still priced in 104 basis points of cuts by year-end, suggesting that a 50-basis-point rate cut is expected at either the November or December meeting.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server