UK CPI Beats Expectations; BOE Remains Cautious on Rate Cuts

TOPICSUK’s Annual Inflation Rises to 2.3%

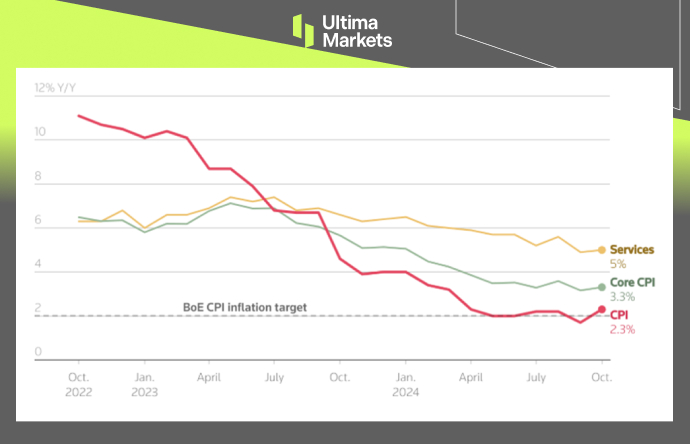

On Tuesday, UK consumer prices increased by an annualized 2.3% in October, driven almost entirely by higher regulated domestic energy tariffs. This followed a 1.7% rise in September, marking the first time since 2021 that inflation dipped below the Bank of England’s (BoE) 2% target.

(UK CPI y/y, Core CPI y/y, and Services CPI y/y Chart, Source: ONS)

UK inflation exceeded expectations last month, returning above the BoE’s target as underlying price pressures accelerated. This explains the BoE’s cautious approach to potential interest rate cuts. After the data release, sterling gained nearly a third of a cent against the U.S. dollar. However, as the dollar strengthened during the New York session, GBP/USD fell by 0.24%, closing at 1.2651.

(GBP/USD Daily Price Chart, Source: Trading View)

Services inflation which is closely monitored by the BoE as a key indicator of domestic price pressures, rose to 5.0% in October from 4.9% in September, aligning with market and BoE projections. Meanwhile, core inflation, which excludes volatile items like energy, food, alcohol, and tobacco, edged up to 3.3% from 3.2%, defying expectations of a decline.

Looking ahead, the BoE has flagged inflationary pressures likely to stem from the new government’s fiscal policies, alongside global uncertainties, including President-elect Donald Trump’s proposed import tariffs, which further cloud the outlook.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server