US Holiday Retail Sales Surge in Q4’23, Defying Projections

TOPICSTags: US retail sales, US Treasury

US Holiday Retail Sales Remain Robust Despite Concerns

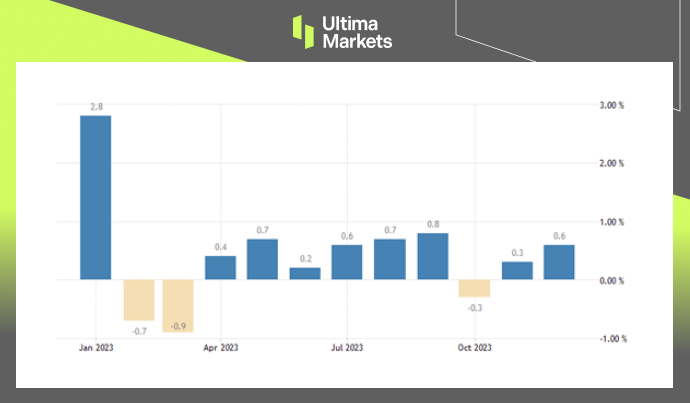

The retail landscape in the United States experienced a notable surge in December 2023, with a month-over-month increase of 0.6%, surpassing the projected 0.4% rise after a 0.3% uptick in November.

This substantial jump, the most significant in three months, was primarily fueled by an impressive 1.2% boost in auto sales. When excluding autos, retail sales still saw a commendable 0.4% increase.

Diverse Sectors Contribute to the Rise

The surge in sales was not confined to a single sector but spanned across various categories. Non-store retailers, attire outlets, general merchandise vendors, assorted retail shops, home improvement and gardening equipment, along with recreational gear, hobbies, musical supplies, and books, all witnessed increased sales. Even food and beverage stores experienced a modest 0.2% rise.

Conversely, certain sectors recorded a decline in sales. Health and personal care, gasoline stations, furniture stores, and electronics plus appliances witnessed a fall in sales. Despite these declines, food services and drinking establishments maintained their sales figures.

(Retail Sales, United States Census Bureau)

Year-End Review: Retail Sales in 2023

Taking a broader view of the year 2023, unadjusted retail sales showed a notable rise of 3.2%. This positive trend underscores the resilience and growth of the retail sector, particularly in the face of economic uncertainties.

Impact on Financial Markets

The positive retail sales data had a ripple effect on financial markets. The yield on the 10-year US Treasury note surged to 4.1%, reaching its highest level in over a month. This uptick in yields contributed to heightened resistance against potential near-term interest rate cuts by the Federal Reserve. Simultaneously, the dollar index extended gains for a third consecutive session, touching 103.5 levels.

(US 10 Year Treasury Yield)

Expert Opinions and Forecasts

Several reputable sources provide insights into the robustness of holiday sales and the broader retail landscape:

- The Star: Advance estimates of U.S. retail and food services sales for December 2023, adjusted for seasonal variation and holiday differences, reached 709.9 billion U.S. dollars.

- AP News: The National Retail Federation reported a 3.8% rise in holiday sales for November, signaling a robust season.

- Reuters: U.S. retail sales exceeded expectations in December, attributed to increased motor vehicle and online purchases.

- Census.gov: The Census Bureau detailed a 0.6% increase in retail trade sales from November 2023, emphasizing the positive trajectory.

- Oberlo: Holiday retail sales in the US have been on a steady rise, with a forecasted increase of up to 4%, reaching $966.6 billion in 2023.

- National Retail Federation: The NRF highlighted that Census Bureau data confirmed a 3.8% growth in core retail sales during the 2023 holiday season.

- U.S. News & World Report: The National Retail Federation reported a 3.8% rise in holiday sales for November, emphasizing a strong season.

Frequently Asked Questions

Q1: How much did holiday sales rise in November 2023?

A1: According to The Star, holiday sales rose by 3.8% in November 2023.

Q2: What sectors witnessed a decline in sales in December 2023?

A2: Sectors such as health and personal care, gasoline stations, furniture stores, and electronics plus appliances witnessed a decline in sales, as reported by Reuters.

Q3: How much did retail trade sales increase in December 2023?

A3: Census.gov detailed a 0.6% increase in retail trade sales from November 2023.

Bottom Line

The surge in US holiday retail sales in December 2023 showcases the resilience and growth of the retail sector. As we move into the new year, the positive momentum observed in the retail landscape sets a promising tone for economic recovery.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server