Zoom Video Communications: A Comprehensive Analysis of 3Q Performance and Future Projections

Explore Zoom’s impressive third-quarter results, where it surpassed revenue and earnings projections. Zoom’s CEO, Eric S. Yuan, highlights the role of innovative features like the Zoom AI Companion in the company’s growth.

Learn about the enterprise segment’s substantial contribution, the outlook for the current quarter, and why Zoom’s stock is on the rise.

Zoom Raised Guidance on Improving Enterprise Base

Releasing its third-quarter financial results, Zoom (ZM.US), the well-known video conferencing business, surpassed market forecasts and gained momentum. The quarter’s overall revenue of $1.14 billion demonstrated a 3.2% year-over-year growth and above the $1.12 billion forecast.

Adjusted earnings per share, which were $1.29 as opposed to the projected $1.10 per share, further demonstrated the outstanding performance.

Enterprise Growth and Revenue Breakdown

A significant driver of Zoom’s success was the enterprise segment, witnessing an impressive 7.5% YoY surge in revenue, totaling $660.6 million. In contrast, the online revenue segment experienced a marginal decline of 2.4%.

This robust growth underscores Zoom’s prowess in catering to the evolving needs of the business landscape.

Insights from CEO Eric S. Yuan

Zoom’s CEO, Eric S. Yuan, expressed his satisfaction with the third-quarter outcomes, emphasizing the company’s commitment to innovation.

He attributed the revenue outperformance to the strategic enhancement of Zoom’s intelligent collaboration platform, featuring groundbreaking elements such as the Zoom AI Companion.

Additionally, Yuan highlighted advancements in customer and employee engagement solutions, contributing to improved customer retention and increased utilization of new AI capabilities.

Forward-Looking Projections

Peering into the current quarter, Zoom projects total revenue ranging from $1.125 billion to $1.130 billion, coupled with earnings per share between $1.13 and $1.15. These figures surpass analysts’ expectations, demonstrating Zoom’s optimistic outlook.

For the full fiscal year, the company anticipates total revenue between $4.506 billion and $4.511 billion, with an expected EPS range of $4.93 to $4.95.

Market Response and Stock Performance

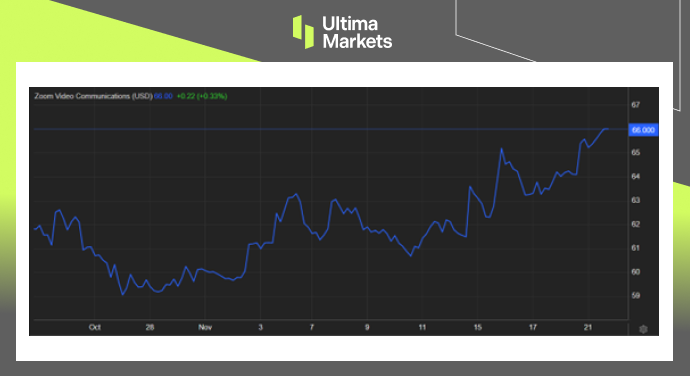

Post-announcement, Zoom experienced a notable uptick, trading higher with a 2.93% gain. Over the past four weeks, the stock price has demonstrated remarkable resilience, registering a substantial 7.97% increase.

(Zoom Stock Performance One-month Chart)

Bottom Line

In conclusion, Zoom’s stellar performance in the third quarter, coupled with optimistic projections, positions the company as a frontrunner in the dynamic landscape of video communications.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2024 Ultima Markets Ltd. All rights reserved.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server