Comprehensive WTI OIL Analysis for January 9, 2024

In this comprehensive analysis, Ultima Markets brings you an insightful breakdown of the WTI OIL for 9th January 2024.

WTI OIL Key Takeaways

- Fund managers are bearish on oil prices: Multiple fundamentals have suppressed crude oil prices: increased inventories, increased production from oil-producing countries, and Saudi Arabia’s official crude oil price reduction yesterday. CFTC showed that fund managers significantly increased their short positions in Brent crude oil and WTI crude oil, the increase was the second largest since 2017.

- Geopolitics supports oil prices: The escalation of short-term geopolitical tensions in the Middle East has triggered supply concerns. After the Houthi armed forces in Yemen attacked ships in the Red Sea, geopolitical risks in the Middle East intensified. To a certain extent, this means that the downward trend of oil prices may be limited.

WTI OIL Technical Analysis

WTI OIL Daily Chart Insights

- Stochastic Oscillator: The indicator once again issued a short signal at the 50 midline, suggesting that the downward trend is not over yet and will downward in the future.

- 33-day moving average: The exchange rate fell rapidly after hitting the 33-day moving average yesterday, falling below the doji bar formed on January 4. The previous 33-day moving average has blocked the further rebound of oil prices, suggesting that the bulls still need to wait.

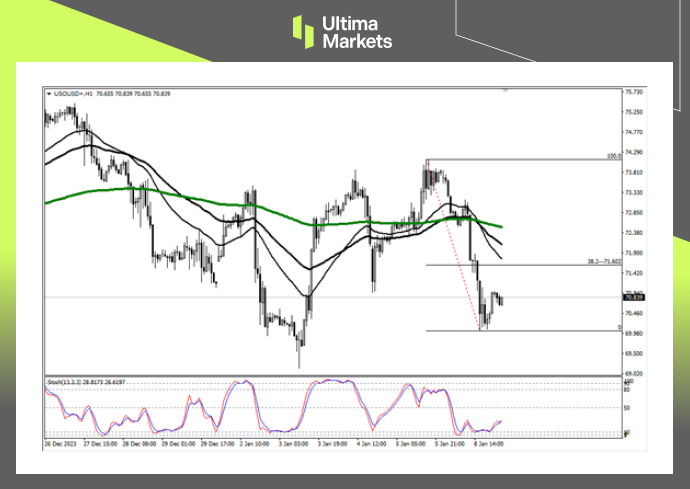

WTI OIL 1-hour Chart Analysis

- Stochastic Oscillator: When oil prices fell rapidly, the indicator did not form an oversold trend and formed a bottom divergence. On the Asian session, oil prices may rebound and rise.

- Fibonacci retracement level: The theoretical target level of a rapid downward trend looks towards the 38.2% Fibonacci retracement level, which is also around the black 33-period moving average. It is worth noting that if oil prices break through such multiple resistance levels, you need to be alert to whether oil prices will usher in a reversal.

Trading Central Pivot Indicator

- According to the trading central in Ultima Markets APP, the central price of the day is established at 71.30,

- Bullish Scenario: Bullish sentiment prevails above 71.30, first target 72.00, second target 72.60;

- Bearish Outlook: In a bearish scenario below 71.30, first target 70.10, second target 69.45.

Conclusion

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4