You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Comprehensive USDX Analysis for September 26, 2023

In this comprehensive analysis, Ultima Markets brings you an insightful breakdown of the USDX for 26th September 2023

Key Takeaways

The Federal Reserve’s stance has emerged as the linchpin shaping the USDX’s performance.

While September saw a halt in interest rate hikes, the dot plot projections signal a potential resurgence in rate increases later in the year.

This is underpinned by a forthcoming, more hawkish monetary policy in the next year, with a notable reduction in the number of projected interest rate cuts.

USDX Technical Analysis

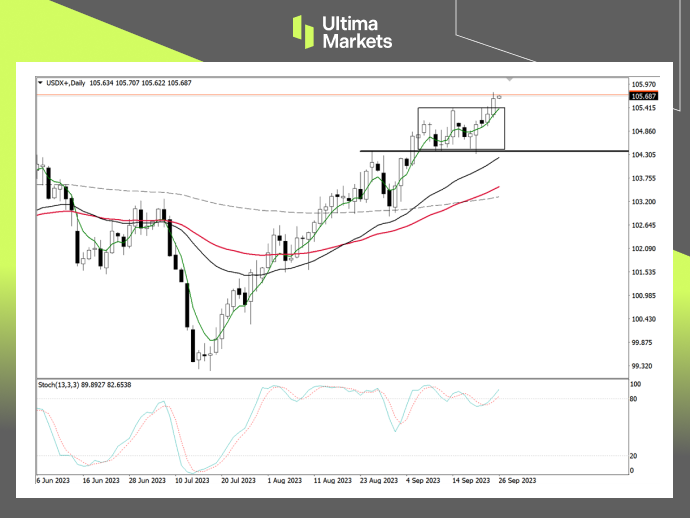

USDX Daily Chart Insights

( Daily chart of USDX, source: Ultima Markets MT4)

Turning our focus to the technical landscape, the USDX exhibits compelling upward momentum.

The daily chart reveals a breakthrough as the US Dollar Index’s price closes above its consolidation range’s upper boundary.

Moreover, the stochastic oscillator, a pivotal technical indicator, has signaled a bullish trajectory.

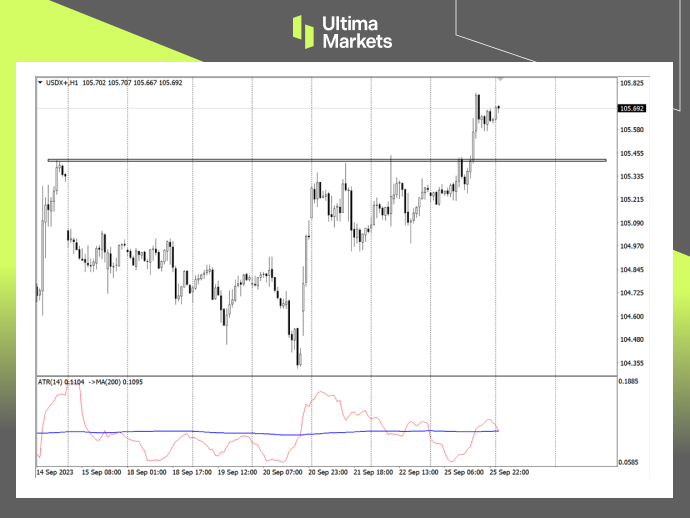

USDX 1-Hour Chart Analysis

(1-hour chart of USDX, source: Ultima Markets MT4)

The one-hour chart presents a more granular picture, with the ATR combination indicator affirming the effectiveness of the recent breakthrough.

Although retracement is conceivable during the Asian trading session, a market rebound is anticipated. The initial target is fixed at the support price of 105.443.

Ultima Markets Pivot Indicator

(1-hour chart of USDX, source: Ultima Markets MT4)

Ultima Market’s MT4 pivot indicator designates the day’s central price at 105.527. For investors and traders, here are the essential projections:

Bullish Scenario:

- Bullish above 105.527

- First target: 105.874

- Second target: 106.123

Bearish Scenario:

- Bearish below 105.527

- First target: 105.282

- Second target: 104.937

These projections, though subject to market dynamics and emerging data, provide a compass for navigating the ever-evolving terrain of financial markets.

Conclusion

لماذا تختار تداول المعادن والسلع مع Ultima Markets؟

توفر Ultima Markets البيئة التنافسية الأفضل من حيث التكلفة والتبادل للسلع السائدة في جميع أنحاء العالم.

ابدأ التداولمراقبة فعالة للسوق أثناء تنقلك

الأسواق عرضة للتغيرات في العرض والطلب

جذابة للمستثمرين المهتمين فقط بالمضاربة على الأسعار

سيولة عميقة ومتنوعة بدون رسوم مخفية

لا يوجد مكتب تداول ولا إعادة تسعير

تنفيذ سريع عبر خادم Equinix NY4