You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

RBNZ might hold rates unchanged while institutions short on NZD

The Federal Reserve Bank of New Zealand will announce the latest interest rate decision on Wednesday, and the market expects to keep the OCR official cash rate unchanged at 5.50%.

At the moment, global economics are cooling, while the figures released by RBNZ are not strong enough.

Consequently, RBNZ gains space to keep interest rates unchanged and time to observe the inflation situation further.

The Intricacies of the New Zealand Economy

NZ economic data displays a mixed picture, with inflation data tapering off despite resilient demand, leaving investors conflicting signals. NZ economic conditions have not weakened as badly as previously expected.

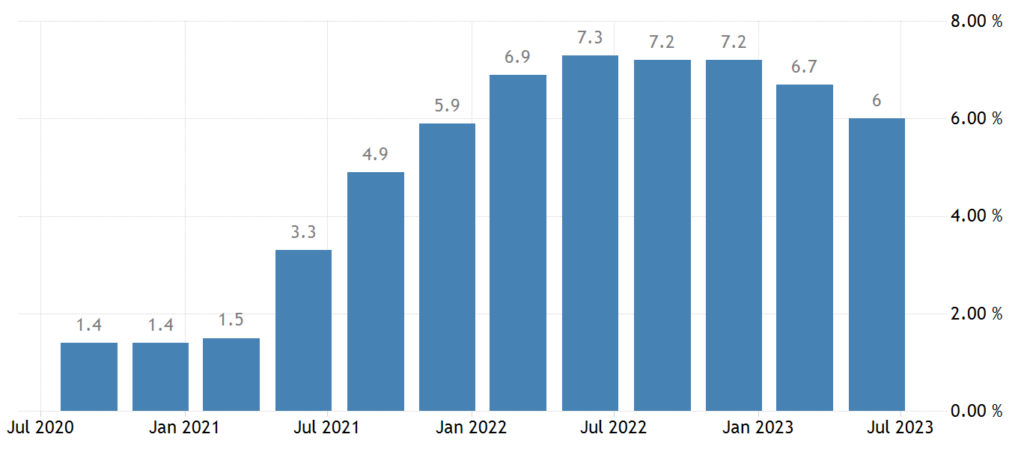

(NZ inflation rates in one year)

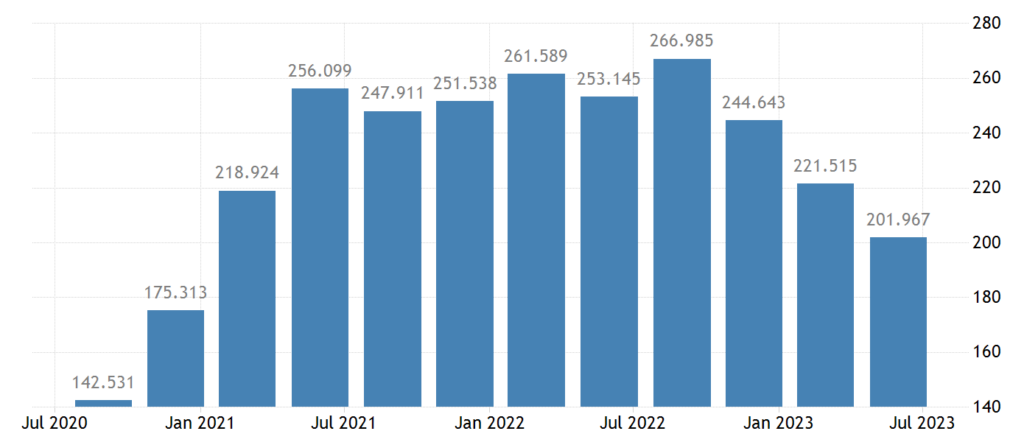

Although inflation has started to fall, it has remained high. The strong labor market has prompted RBNZ to postpone an expected rate cut originally scheduled for the fourth quarter of 2023 until the second quarter of 2024.

The wage growth has declined, however, stayed at an elevated level, hampering RBNZ to reach its inflation goal. NZ’s GDP growth rate is expected to pick up slightly in 2023, showing some resilience in its economy.

(NZ job vacancies decreased since July 2022)

The Uncertainty Surrounding OCR

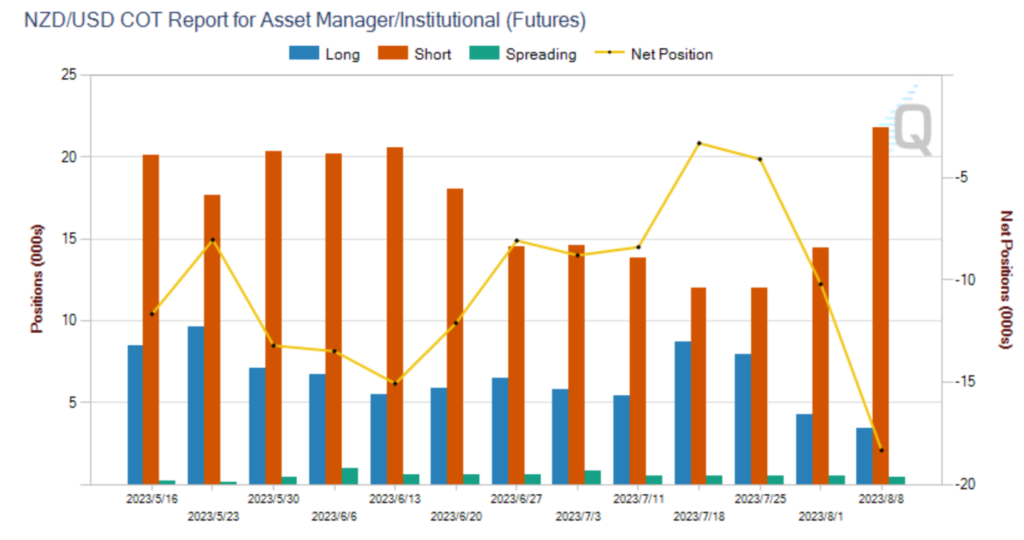

A ‘watch, worry, and wait’ stance seems the most likely outcome of the OCR review. However, some institutions believe it is possible to see rates go up to 5.75% in the future. The divergence reflects market uncertainty toward inflation and the economic outlook.

(Institutional short positions increased on NZD/USD)

The positions held by Institutional investors last week showed bearish sentiments on NZD/USD. If RBNZ unexpectedly raises interest rates, NZ’s exchange rate will rise rapidly in the short run.

(NZD/USD weekly chart, Ultima Markets MT4)

Institutional Sentiments on NZD/USD

From a technical standpoint, the NZD /USD weekly cycle has fallen into short-term weakness, and the bottom is about to look at the Fibonacci 61.8% retracement position of the upward trend since September 2022.

The Crucial Role of Data and Monetary Policy

In conclusion, the outcome of the RBNZ’s decision hinges significantly on a blend of mixed economic data, inflation trends, and the broader economic outlook.

Investors are well-advised to keep a keen ear out for the central bank’s commentary on inflation and the overall state of the economy during the review.

Furthermore, observing the subsequent market response will provide invaluable insights into the trajectory of New Zealand’s monetary policy.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Warum mit Ultima Markets Metalle und Rohstoffe handeln?

Ultima Markets bietet das wettbewerbsfähigste Kosten- und Börsenumfeld für gängige Rohstoffe weltweit.

Mit dem handel beginnenÜberwachung des Marktes von unterwegs

Märkte sind anfällig für Veränderungen in Angebot und Nachfrage

Attraktiv für Anleger, die nur an Preisspekulationen interessiert sind

Umfangreiche und vielfältige Liquidität ohne versteckte Gebühren

Kein Dealing Desk und keine Requotes

Schnelle Ausführung über den Equinix NY4-Server