You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Focus on GBP/AUD today.

On Fundamentals, BoE raised its benchmark interest rate by 25 bps yesterday, reaching the highest level since 2008. Rising interest rates mean higher borrowing costs, meaning more pressure on many homeowners. The UK continues to be on the edge of recession. Separately, RBA’s monetary report suggests suspending interest rate hikes, however, leaves room for another 15-bps raise.

BoE’s monetary policy was significantly more hawkish than RBA’s, resulting in an appreciation of GBP/AUD since February 2023. However, BoE’s policy no longer brought bullish sentiment on the pound but worries on the British outlook. At present , the market is certian on the future peak interest rate of the RBA, which will lead to a potential bullishness on the Australian dollar .

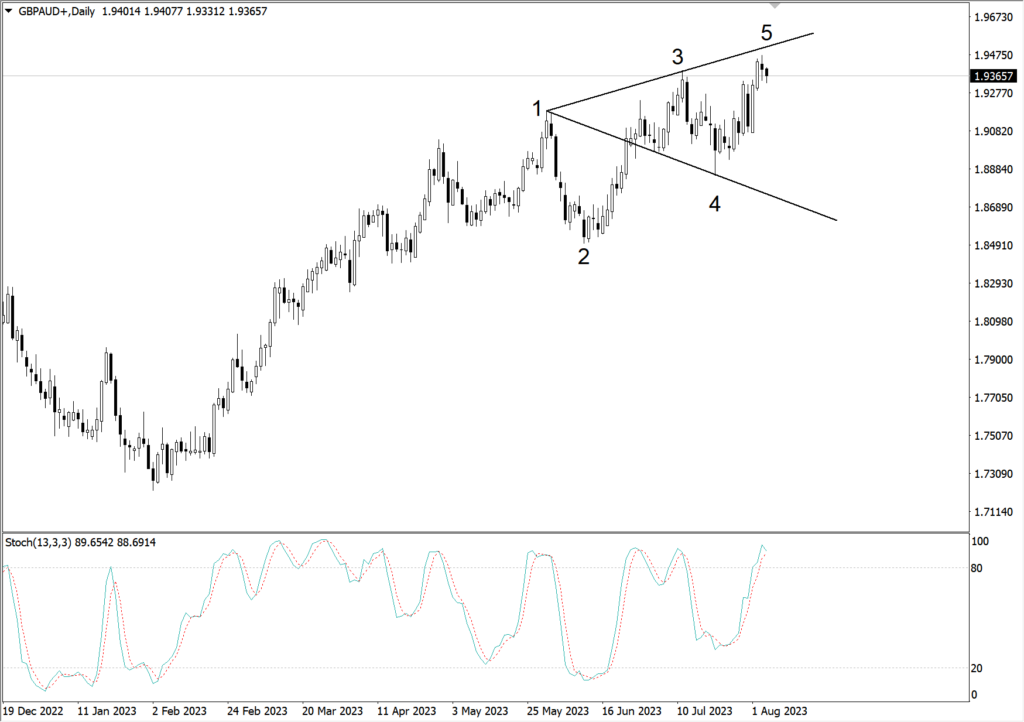

Technically speaking, the GBP/AUD daily cycle presents a potential Wolf Wave structure, but the price action structure does not display a clear bearish signal at moment.

(GBP/AUD daily cycle, Ultima Markets MT4)

The Stochastic Oscillator shows no dead cross on the daily cycle. Please be aware of GBP/JPY’s next bullish trend.

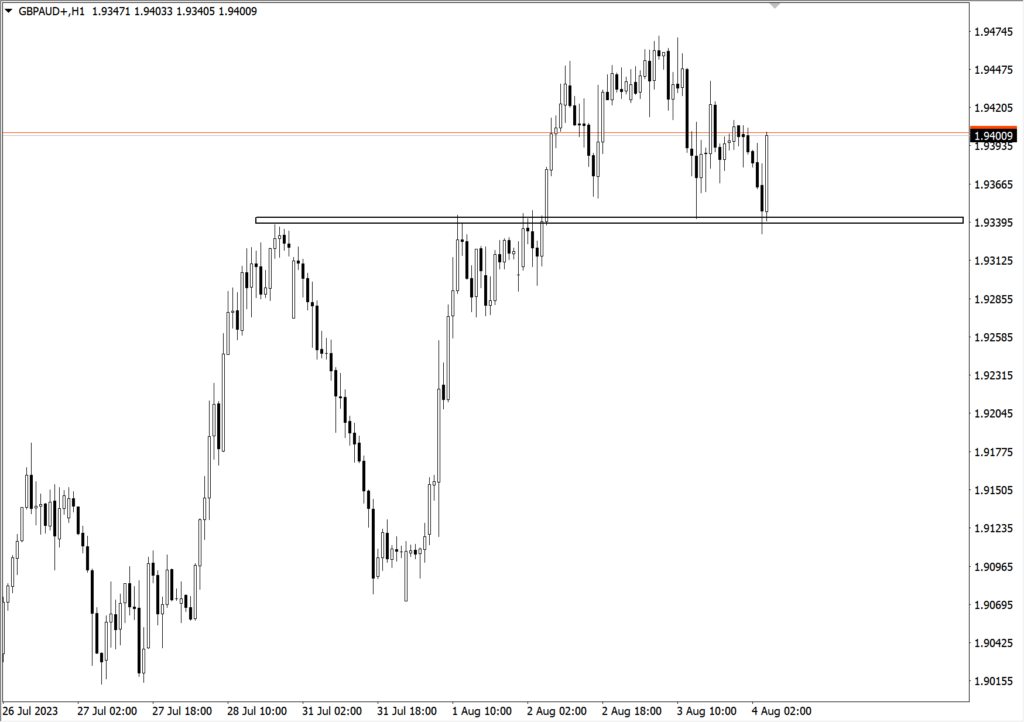

(4-hour GBP/AUD cycle, Ultima Markets MT4 )

The 4-hour Elliott Wave structure of GBP/AUD suggests that it may be in a double-saw-tooth rebound phase. After the market confirms the bearish trend, it is possible to pave a sharp downward path.

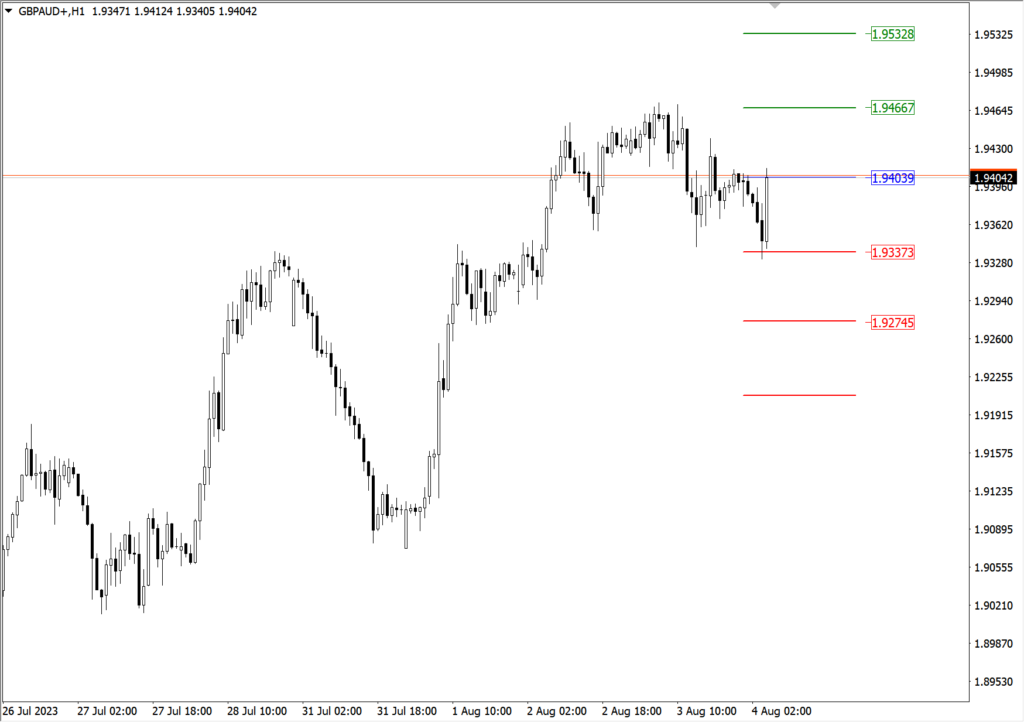

(1-hour GBP/AUD cycle, Ultima Markets MT4)

On 1-hour cycle of GBP/AUD, a turning point emerged. The exchange rate fell rapidly and was close to the previous breakthrough price. On August 2, the price action formed a potential head-and-shoulders structure. If it falls below the 1.9338 neckline, the probability of going bearish will increase.

(1- hour GBP/AUD cycle, Ultima Markets MT4)

According to the pivot indicator in Ultima Markets MT4 , the central price of the day is 1.94039 ,

Bullish above 1.94039, the first target is 1.94667, and the second is 1.95328.

Bearish below 1.94039, the first target is 1.93373, and the second is 1.92745.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Pourquoi trader des métaux et des matières premières avec Ultima Markets ?

Ultima Markets offre l'environnement de coûts et d'échange le plus compétitif pour les matières premières les plus répandues dans le monde.

Commencer à traderSurveiller le marché en déplacement

Les marchés sont sensibles aux changements de l'offre et de la demande

Attrayant pour les investisseurs uniquement intéressés par la spéculation sur les prix

Liquidité profonde et diversifiée sans frais cachés

Pas de bureau de négociation et pas de requotes

Exécution rapide via le serveur Equinix NY4