You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Snowflake Steady Expansion Amid Challenging Times

In the dynamic landscape of cloud data platforms, Snowflake (NYSE:SNOW) has emerged as a key player, evident in its stellar performance in the third quarter of fiscal 2024. The company’s financial results not only surpassed expectations but also showcased robust growth across crucial financial metrics.

Snowflake’s Financial Results Overview

Revenue Triumph

Snowflake reported a total revenue of $734.17 million for Q3, marking an impressive 32% increase compared to the same quarter in the previous year. This figure not only exceeded industry projections but underscored Snowflake’s resilience and adaptability in navigating challenging economic climates.

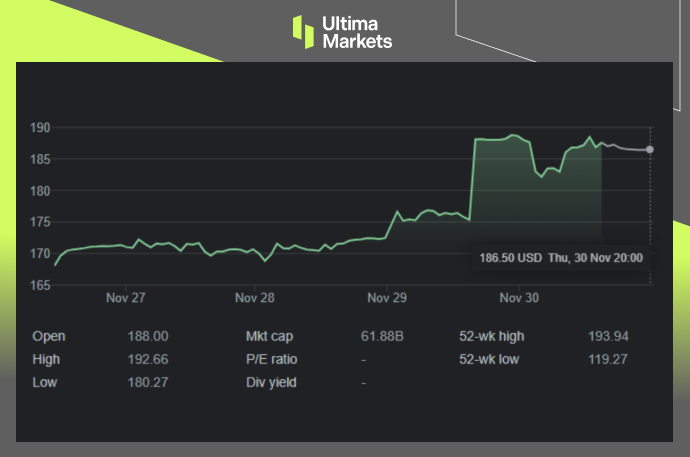

Product Revenue Surge Snowflake’s Stock Prices

A significant driver of Snowflake’s success lies in its product revenue, which experienced a remarkable 34% year-over-year growth. Product sales, totaling $698.5 million, contributed substantially to the company’s overall financial prowess.

Wall Street Beat: Earnings and Estimates for Snowflake

Exceeding Expectations

On the bottom line, Snowflake demonstrated its financial acumen by earning 25 cents per share, a notable achievement surpassing the predicted 16 cents per share estimated by industry analysts. This stellar performance underscores Snowflake’s commitment to delivering value to its stakeholders.

Zacks Consensus Estimate Conquered

The Zacks Consensus Estimate, a barometer of market sentiment, was not only met but surpassed by Snowflake’s non-GAAP earnings of 25 cents per share, showcasing a 66.67% beat. This triumph solidifies Snowflake’s position as a market leader.

(Snowflake Stock Performance Weekly Chart)

Key Financial Metrics: A Deep Dive

Product Sales and Growth

Snowflake’s Q3 results unveiled a product sales figure of $698.5 million, reflecting a 34% increase from the previous year. This robust growth in product sales signifies Snowflake’s prowess in the highly competitive cloud data platform sector.

Remaining Performance Obligations

An essential forward-looking metric, Snowflake’s remaining performance obligations experienced a notable 23% increase, reaching $3.7 billion. This metric underlines the company’s promising future revenue streams and sustained growth potential.

Customer Landscape

Snowflake’s ability to secure major accounts is evident in its impressive customer base. With 436 customers generating over $1 million in product revenue on a trailing 12-month basis, Snowflake showcases its capacity to not only land but also expand within its customer portfolio.

Snowflake’s Future Projections: Sustaining Rapid Growth

Q4 Outlook

Snowflake’s optimistic outlook extends to the fourth quarter, with an anticipated 29-30% year-over-year growth in product revenue, projecting figures between $716-721 million. This forecast sets the stage for a strong finish to the fiscal year.

Full Fiscal Year Projections

Looking beyond Q4, Snowflake envisions a robust 37% expansion in product revenue, totaling $2.65 billion for the full fiscal year. This forward-looking projection positions Snowflake as a company poised for continued rapid growth amid sustained customer adoption.

Frequently Asked Questions

Q: How did Snowflake perform compared to Wall Street expectations in Q3?

A: Snowflake not only met but exceeded Wall Street expectations in Q3, reporting a total revenue of $734.17 million, surpassing the estimated $712.78 million.

Q: What contributed to Snowflake’s impressive earnings beat?

A: Snowflake’s stellar earnings beat can be attributed to a 34% year-over-year growth in product revenue, reaching $698.5 million, showcasing the company’s strong market position.

Q: What contributed to Snowflake’s impressive earnings beat?

A: Snowflake’s stellar earnings beat can be attributed to a 34% year-over-year growth in product revenue, reaching $698.5 million, showcasing the company’s strong market position.

Q: What are Snowflake’s projections for the upcoming fiscal year?

A: Snowflake projects a robust 37% expansion in product revenue for the full fiscal year, anticipating a total of $2.65 billion, indicative of sustained rapid growth.

Bottom Line

In conclusion, Snowflake’s third-quarter performance not only exceeded expectations but also positioned the company for sustained success in the highly competitive cloud data platform industry.

With a strategic focus on product revenue growth and a solid customer base, Snowflake remains a frontrunner in the evolving landscape of cloud technology.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2023 Ultima Markets Ltd. All rights reserved.

Pourquoi trader des métaux et des matières premières avec Ultima Markets ?

Ultima Markets offre l'environnement de coûts et d'échange le plus compétitif pour les matières premières les plus répandues dans le monde.

Commencer à traderSurveiller le marché en déplacement

Les marchés sont sensibles aux changements de l'offre et de la demande

Attrayant pour les investisseurs uniquement intéressés par la spéculation sur les prix

Liquidité profonde et diversifiée sans frais cachés

Pas de bureau de négociation et pas de requotes

Exécution rapide via le serveur Equinix NY4