You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

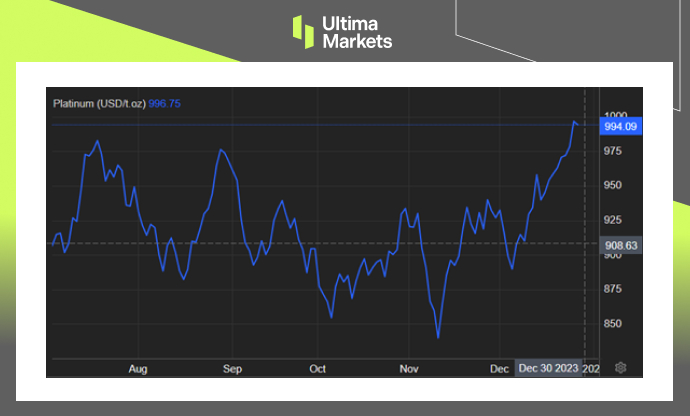

Surge in Precious Metal Demand Boost Platinum to Six-Month High

TOPICSTags: Platinium, Precious metals

Precious Metal Demand Surges, Boosting Platinum to Six-Month High

In recent market movements, platinum futures have surged to impressive levels, breaking the $950 barrier and attaining near six-month highs. This upswing is attributed to a combination of factors, including a weaker dollar and optimistic economic outlook.

In this article, we delve into the dynamics influencing platinum prices and explore the key factors shaping the platinum futures market.

Weakening Dollar and Economic Outlook

The recent rally in platinum prices is closely tied to a softer dollar and positive economic indicators. Platinum Quotes reveal a robust performance, with the precious metal capitalizing on cooling inflation data from both the US and Europe.

This has fueled expectations of early rate cuts by major banks in 2024, further boosting the appeal of platinum as an investment.

Supply and Demand Dynamics

The platinum market is currently navigating supply and demand imbalances. Platinum Apr ’24 Futures Contract Specifications outline the intricacies of the CME platinum futures contract, calling for the delivery of 50 troy ounces of platinum with 0.9995 fineness.

Despite this, the World Platinum Investment Council predicts an unprecedented shortfall of 1.07 million ounces in 2023 due to increased demand. The demand surge, growing at an annual rate of 26% to 8.15 million ounces, is fueled by rising palladium substitution and higher loadings.

Factors Influencing the Market

The current market scenario is shaped by various factors. Platinum Continuous Contract Overview – PL00 provides a comprehensive overview, emphasizing the role of intensified South African power shortages and diminished Russian output in contributing to a 3% supply decrease, amounting to 7.08 million ounces.

Despite these challenges, platinum remains 8% lower year-to-date, primarily due to a decline in catalytic converter applications. The increasing market share of battery-powered electric vehicles and China’s gradual economic recovery are key contributors to this decline.

Frequently Asked Questions

Q1: What are the key drivers behind the recent surge in platinum prices?

A1: The recent surge in platinum prices is attributed to a combination of factors, including a weaker dollar, positive economic indicators, and expectations of early rate cuts by major banks in 2024.

Q2: What factors contribute to the supply and demand imbalances in the platinum market?

A2: Rising demand, fueled by increased palladium substitution and higher loadings, is causing a supply deficit in the platinum market. Factors such as South African power shortages and reduced Russian output are also contributing to a 3% decrease in supply.

Q3: Why has platinum experienced a year-to-date decline despite supply deficits?

A3: Despite supply deficits, platinum has seen a year-to-date decline of 8%, primarily due to a decrease in catalytic converter applications. The growing market share of battery-powered electric vehicles and China’s gradual economic recovery are additional factors influencing this decline.

Bottom Line

In conclusion, the platinum futures market is witnessing dynamic shifts driven by a complex interplay of economic factors, supply and demand dynamics, and market trends.

Investors and enthusiasts alike are closely monitoring these developments as platinum continues to assert itself as a crucial player in the precious metals landscape.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2023 Ultima Markets Ltd. All rights reserved.

Pourquoi trader des métaux et des matières premières avec Ultima Markets ?

Ultima Markets offre l'environnement de coûts et d'échange le plus compétitif pour les matières premières les plus répandues dans le monde.

Commencer à traderSurveiller le marché en déplacement

Les marchés sont sensibles aux changements de l'offre et de la demande

Attrayant pour les investisseurs uniquement intéressés par la spéculation sur les prix

Liquidité profonde et diversifiée sans frais cachés

Pas de bureau de négociation et pas de requotes

Exécution rapide via le serveur Equinix NY4