You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

TSM October Revenue Explode, Surpassing NT$15 Trillion Value

TOPICSTSM Achieved a Record-high Revenue Last Month

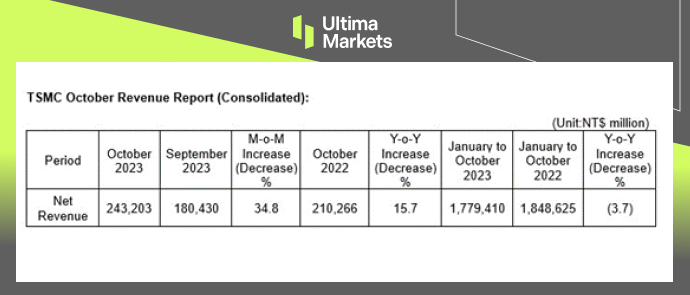

On November 10, Taiwan Semiconductor Manufacturing Company (TSM.US) announced that its October revenue was a record-breaking US$7.53 billion (NT$243.2 billion), representing a notable 34.8% increase from September and a 15.7% raise from the same period last year.

(TSMC Consolidated October Revenue)

Unveiling the TSM’s Revenue Numbers

TSMC’s cumulative revenue for the first 10 months of 2023 stood at an impressive US$55.6 billion, showcasing a modest 3.7% decline from the corresponding period in 2022.

The company’s resilience in navigating the challenges posed by weaker global demand in certain sectors, particularly consumer electronics, is evident in these numbers.

The surge in demand for TSMC’s cutting-edge 3nm technology played a pivotal role in its ADR surging more than 6% following the earnings release.

TSM’s Leadership Insight

C. C. Wei, TSMC’s CEO, expressed unwavering optimism regarding the chip market during a recent statement. He anticipates that the company will soon overcome the challenges of a prolonged sluggishness, primarily attributed to the lingering effects of the COVID-19 pandemic.

The surge in the AI industry, driven by an increased need for chips used in training large language models, has significantly contributed to TSMC’s positive outlook.

TSM’s Technological Prowess

TSMC’s third-quarter revenue surge was underpinned by its advanced technology, with the 3nm, 5nm, and 7nm processes collectively accounting for an impressive 59% of the company’s total revenue.

Looking ahead, TSMC is set to push the boundaries further by mass-producing an even more advanced 2nm process in 2025. This ambitious move is poised to solidify TSMC’s position as a trailblazer in high-end technology development.

TSM’s Future Projections

As we look toward the future, TSMC’s fourth-quarter revenue for 2023 is anticipated to range between US$18.8 billion and US$19.6 billion, with an estimated midpoint of US$19.2 billion (approximately NT$614.4 billion at the current exchange rate of NT$32 per US$1).

This represents an impressive approximately 11.1% increase on a quarterly basis. Despite the expectation of a slight dip in revenue in November and December compared to the stellar October figures, TSMC remains confident in achieving its financial forecast target.

The company estimates that the revenue in the remaining two months will average around US$5.84 billion.

Bottom Line

In conclusion, TSMC’s stellar performance in October is a testament to its resilience, technological prowess, and strategic vision.

The company’s commitment to advancing semiconductor technology, coupled with its optimistic outlook despite global challenges, positions TSMC as a formidable leader in the high-end technology landscape.

As TSMC continues to push the boundaries of innovation, the industry watches eagerly to witness the unfolding chapters of its success story.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2023 Ultima Markets Ltd. All rights reserved.

Pourquoi trader des métaux et des matières premières avec Ultima Markets ?

Ultima Markets offre l'environnement de coûts et d'échange le plus compétitif pour les matières premières les plus répandues dans le monde.

Commencer à traderSurveiller le marché en déplacement

Les marchés sont sensibles aux changements de l'offre et de la demande

Attrayant pour les investisseurs uniquement intéressés par la spéculation sur les prix

Liquidité profonde et diversifiée sans frais cachés

Pas de bureau de négociation et pas de requotes

Exécution rapide via le serveur Equinix NY4