Ultima Markets

You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

The Canadian dollar weakened to an 11-week low against its U.S. counterpart on Wednesday after the Bank of Canada implemented a larger-than-usual interest rate cut, while the U.S. dollar extended its recent large gains. USDCAD rose 0.15%, closing at $1.3837.

(USDCAD Daily Price Chart, Source: Trading View)

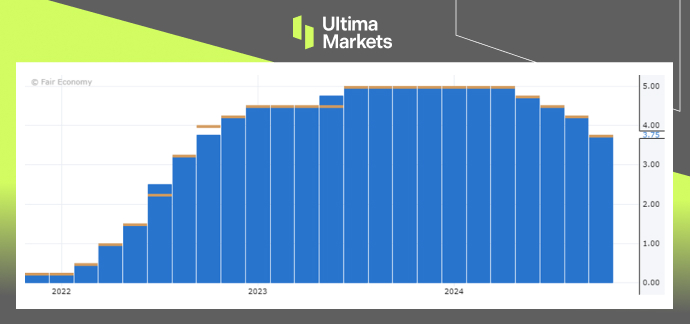

The Bank of Canada lowered its benchmark rate by 50 basis points to 3.75%, as anticipated, and highlighted signs that Canada is returning to a low-inflation environment. This was the first rate cut of this magnitude in 15 years, excluding pandemic-related adjustments, and it brings the total easing since June to 125 basis points.

(Bank of Canada Overnight Rate, Source: Forex Factory)

Key indicators including real GDP, the labor market, and inflation are all pointing to a weaker outlook than the Bank of Canada had previously forecasted. Consumer prices in Canada slowed to 1.6% last month, falling below the BoC’s 1% to 3% target range, with the midpoint being 2%. GDP grew at a modest 0.2% rate in July, and a preliminary estimate suggests that growth likely stalled in August.

Additionally, investors are speculating that the policy rate could be reduced below the upper bound of the 2.25%-3.25% neutral range as early as January.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server