Ultima Markets

You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Bank of Canada May Lower Rates Faster Than the Fed

TOPICSTags: Bank of Canada, FED, Inflation, Rate Cut, Unemployment

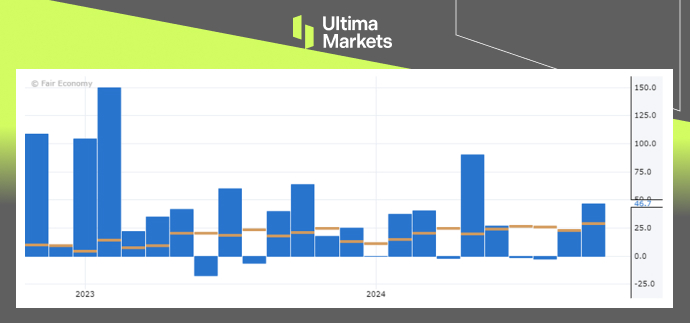

Data released last Friday showed that Canada added 47,000 jobs in September, surpassing expectations of 27,000 jobs. However, a Bank of Canada survey indicated that businesses still face weak demand, leaving the market’s implied odds of an unusually large half-percentage-point rate cut at the bank’s upcoming policy decision on Oct. 23 largely unchanged at around 50%.

(Canada Unemployment Change, Source: Forex Factory)

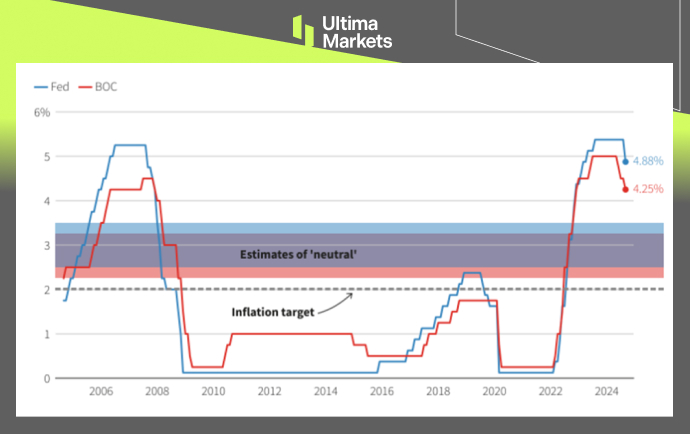

The Bank of Canada is likely to lower interest rates to a neutral level—one that neither restricts nor stimulates the economy—faster than the U.S. Federal Reserve. This is due to weak Canadian growth, which raises the risk of inflation falling below the central bank’s 2% target. The BoC has more urgency than the Fed in reaching its neutral rate, as slower growth in Canada indicates slacker in the economy.

(Interest Rates of The Federal Reserve and Bank of Canada)

Furthermore, Canada’s economy has grown more slowly in recent quarters than the 2.4% potential growth rate the BoC targets. This has contributed to cooling inflation, which reached 2% in August. However, the central bank warns that additional economic slack would be unfavourable.

The BoC estimates its neutral interest rate to fall between 2.25% and 3.25%, with a midpoint of 2.75%. Similarly, U.S. Federal Reserve officials estimate their neutral rate around 2.9%, with a central tendency ranging from 2.5% to 3.5%.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server