Ultima Markets

You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

Market awaits inflation data to gauge US rate cut likelihood.

TOPICSTags: Federal Reserve, Inflation, PCE, XAUUSD

Financial market remains fixated upon future data from the United States, especially pertaining to inflation to gauge the likelihood of an early rate cut. Likewise, comments from Fed officials will be monitored at the same time, with at least ten are due to speak this week.

Previously, data from US showed that durable goods orders experienced its largest downfall in nearly 4 years. The fall was mainly due to lower business investment on equipment, an early sign that the economy is losing its momentum.

The report joined a stream of weak data which includes retail sales, housing starts and manufacturing production. Softness which has been seen in these data are blamed on cold temperatures from last month as well as difficulties of adjusting the data to seasonal fluctuations.

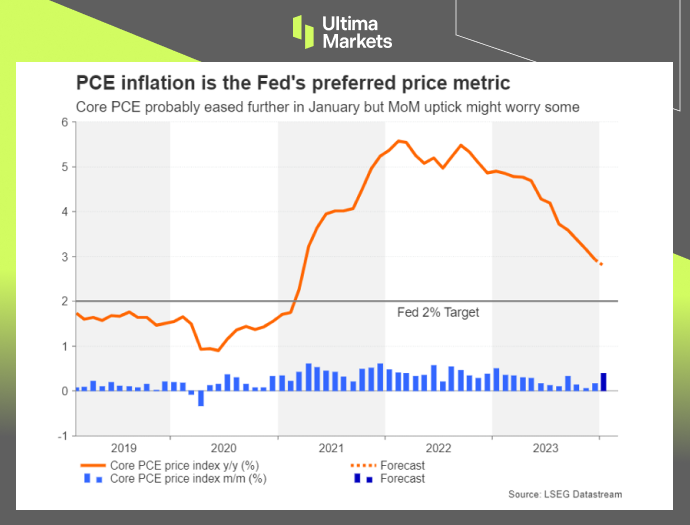

(US PCE Price Index)

Nonetheless, the main concern for both investors and Fed alike are inflationary pressure. Although recent reports show substantial depreciation in price levels, some Fed officials signalled that they are in “no hurry” to cut interest rates. They argued that upside risks on inflation continues to lurk, which may cause price pressure to resurge.

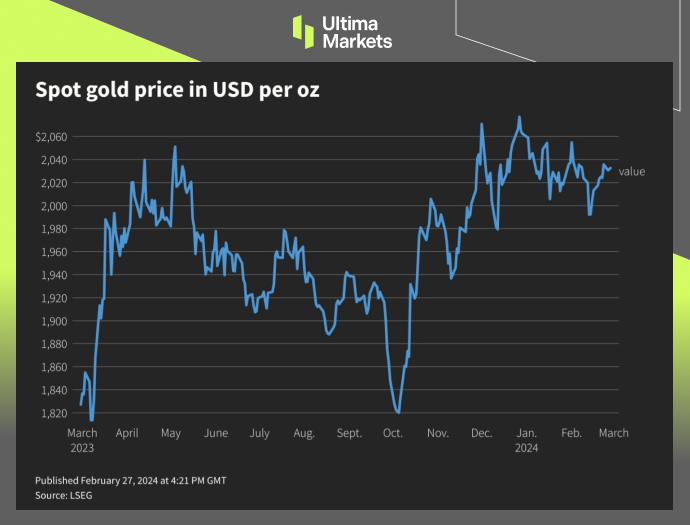

(Gold spot price per oz)

As of writing, gold price dipped 0.01% to 2030.29 while the US dollar index ticked up 0.02% to 103.80.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server