You are visiting the website that is operated by Ultima Markets Ltd, a licensed investment firm by the Financial Services Commission “FSC” of Mauritius, under license number GB 23201593. Please be advised that Ultima Markets Ltd does not have legal entities in the European Union.

If you wish to open an account in an EU investment firm and protected by EU laws, you will be redirected to Ultima Markets Cyprus Ltd (the “CIF”), a Cyprus investment firm duly licensed and regulated by the Cyprus Securities and Exchange Commission with license number 426/23.

The Impact of CPI Data on Interest Rate Expectations and Dollar Trading

The latest CPI data for the US has sent ripples through financial markets, particularly affecting expectations around interest rate cuts and the performance of the dollar. Let’s delve into the details and explore the key factors shaping these dynamics.

Rising Inflation Rates Defy Market Expectations

CPI Data Dashes Hopes

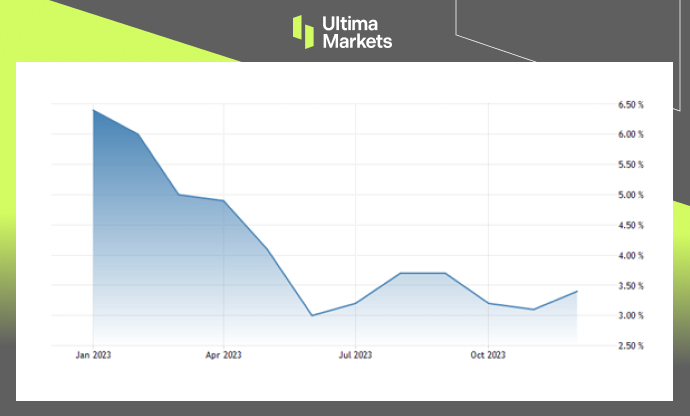

The annual inflation rate in the US surged to 3.4% in December 2023, up from the previous month’s five-month low of 3.1%. This exceeded market expectations and has significant implications for the economic landscape.

(US Consumer Price Index, BLS)

Federal Reserve’s Cautionary Stance on Rate Cuts

Dollar Rallies as Fed Cut Outlook Dims

In response to the higher-than-expected inflation, Federal Reserve officials have adopted a cautious stance on potential rate cuts.

Cleveland Fed President Loretta Mester emphasized that the task of curbing inflation is yet to be accomplished.

The possibility of a rate cut in March, initially considered by the Federal Open Market Committee (FOMC), is now being viewed with caution.

Dollar at One-Month High

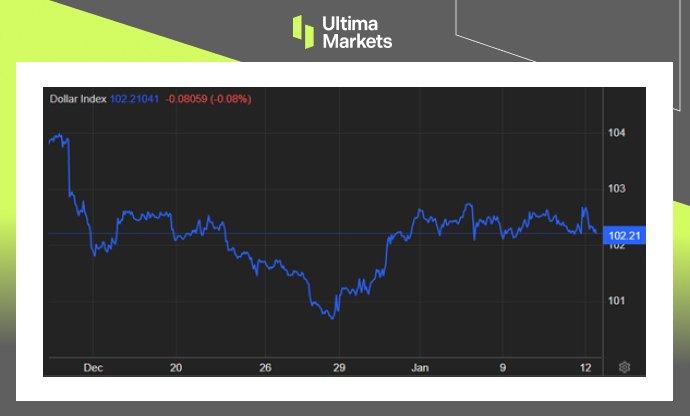

As market expectations of a rate cut in March have softened, the dollar has surged to a one-month high. The dollar index reached 102.6, indicating a shift in perspective that the Federal Reserve may delay the initiation of interest rate cuts.

(Dollar Index One-month Chart)

Market Reactions and Speculations

Wall Street Holds Back on Big Bets

Wall Street is treading cautiously as it awaits further clarity on the disinflation trend. The recent consumer price index report is poised to provide insights into whether the trend is continuing or if a shift is imminent.

ET Explainer: Why the Fed May Dash Rate Cuts Hope

The Economic Times delves into the factors influencing the Federal Reserve’s decisions. Despite a 525 basis point increase in interest rates over the past year-and-a-half, key US economic growth indicators play a pivotal role in shaping the Fed’s approach.

Global Implications and Market Outlook

Canada’s December Inflation

The impact is not confined to the US alone. Canada, too, is witnessing shifts in market expectations, with the possibility of interest rate cuts seeing a decrease after December’s inflation data.

ASX Set to Dip

The ASX market is anticipating a dip as the latest US CPI data dashes hopes of immediate rate cuts. The market is closely monitoring the Federal Reserve’s stance for cues on future interest rate movements.

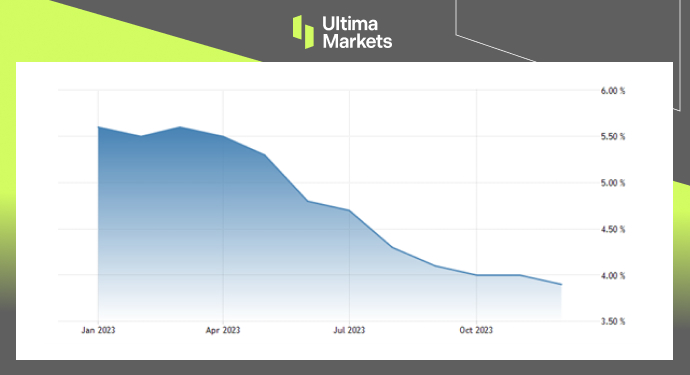

(US Core Consumer Price Index, BLS)

Frequently Asked Questions

1. How has the CPI data impacted the US dollar?

The CPI data has led to a surge in the US dollar, reaching a one-month high, as market expectations for a March rate cut have diminished.

2. What is the Federal Reserve’s current stance on rate cuts?

Federal Reserve officials are adopting a cautious approach, with some indicating that a potential rate cut in March may be premature, considering the persistent inflationary pressures.

3. How are global markets reacting to the CPI data?

Global markets, including Canada and ASX, are adjusting their expectations based on the CPI data, with implications for interest rates and market performance.

Bottom Line

The interplay between CPI data, interest rate expectations, and dollar trading is shaping the financial landscape. Market participants are closely monitoring central bank decisions and economic indicators for insights into future trends.

Explore Ultima Markets News Hub

Stay Informed with the Latest Updates – Dive into Our Articles

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Copyright © 2023 Ultima Markets Ltd. All rights reserved.

ทําไมต้องซื้อขายโลหะมีค่าและสินค้าโภคภัณฑ์กับ Ultima Markets?

Ultima Markets ให้บริการด้วยต้นทุนที่เหมาะสมแข่งขันได้ในสภาพแวดล้อมการซื้อขายที่ดีที่สุดสำหรับสินค้าที่เป็นที่นิยมแพร่หลายทั่วโลก

เริ่มการซื้อขายตรวจสอบความเป็นไปของตลาด

ตลาดมีความอ่อนไหวต่อการเปลี่ยนแปลงของอุปสงค์และอุปทาน

ดึงดูดนักลงทุนที่สนใจเฉพาะการเก็งกําไรราคา

สภาพคล่องที่สูงและหลากหลายโดยไม่มีค่าธรรมเนียมแอบแฝง

ไม่มี dealing desk และไม่มี requotes

การดําเนินการที่รวดเร็วผ่านเซิร์ฟเวอร์ Equinix NY4